Dixons Carphone smashes forecasts

17th December 2014 11:00

by Lee Wild from interactive investor

Share on

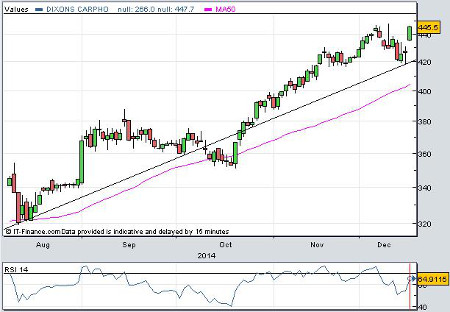

Maiden half-year results from Dixons Carphone (DC.) did not disappoint. Four months after the electronics retailer and mobile phone seller's £3.7 billion merger, sales growth has smashed City expectations and the business has been stealing market share both here and overseas. That's inevitably led to earnings upgrades and a 4% jump in the share price to a near-record high. The tie-up is clearly paying off.

Chief executive Sebastian James certainly thinks so. "The integration of our business seems to be going better than I dared hope," he said Wednesday "and our integrated stores are trading very well which augurs well for the future."

Like-for-like sales rose by 5% in the 31 weeks ended 1 November 2014 and underlying operating profit rose by 18% to £100 million. Underlying pre-tax profit surged by 30% to £78 million thanks to a lower interest charge following the redemption of bonds held by Dixons Retail in August. Consensus estimates were for profit of £79 million and £58 million respectively.

Crucially, sales rocketed 9% during the second quarter. Much of the improvement during the three months was down to "a barnstorming performance" in the UK & Ireland where sales jumped 11%, aided by rivals like Phones 4U going bust. Black Friday also encouraged shoppers to get their Christmas gifts in early this year. Northern Europe generated an extra 9% of income, too, offsetting weakness in Spain.

Integration is "going better than I dared hope," says James, who has now brought the target of at least £80 million of savings by 2017-18 forward by one year. "We remain comfortable with market expectations for this year."

Investec Securities keeps 2015 estimates unchanged, but the news on savings drives profit forecasts for the following two years up by 2.5% and 4% respectively. The broker now expects underlying pre-tax profit of £337 million in the year to 30 April, giving underlying earnings per share (EPS) of 21.3p, rising to 27.2p the year after.

Investec reckons the shares are worth 465p based on a 20% calendar year 2015 price/earnings (P/E) premium to the UK retail sector.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.