City view: Buy or sell Vodafone?

17th December 2014 12:17

by Harriet Mann from interactive investor

Share on

A 226-page report on the European telecoms sector landed with a thump on our desk Wednesday morning, and the busy analysts at Citi reckon things are looking good for the industry. With improving networks boosting consumer interest the sector's valuations are hugging all-time highs, but the broker spies plenty of growth opportunities as companies attempt to solidify their recovery.

It’s the new 4G wireless network that’s creating a buzz. Faster internet speeds and stronger connection means web pages load instantly - song downloads take seconds, an album less than a minute and a full-length HD movie around five minutes. No wonder consumers are taking a fancy to the fourth generation network, and its increasing popularity has helped the European telecoms sector outperform the market by 5% in the year to date and 10% over the last three months.

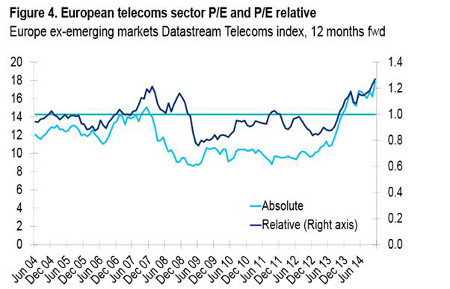

This rally has pushed sector forward price/earnings (PE) multiples to 10-year highs and its enterprise value-to-cash profit ratio (EV/EBITDA) has broker above its 10-year average; not cheap in historical terms, then.

Source: Citi

"As a result it is not surprising to see some settling back but we see the turn-around in the mobile industry’s fortunes as soundly based, and note that its pricing is now, finally, aligned with the growing data category," they said.

Vodafone

In the third quarter,typically the strongest period, some operator's revenue growth rose at its quickest pace for over two years. data volume jumped by 64% year-on-year, video traffic swelled by 88%, with a rise in Youtube and Facebook traffic volumes, at 130% and 110% respectively. But the industry has upside, with revenues in the UK trading 11% below its peak (see chart).

As 4G is quickly taken up, the pricing power of mobile operators is expected to improve, with wholesale price discounts to retail narrowing, hitting mobile virtual network operators (MVNO). Capex is also set to rise and the industry is poised to see more M&A activity.

"We see Vodafone as a key megacap play on European 4G where it appears to have got off to a strong start," says Citi. "We consequently see Vodafone as a good way to play a 4G-driven recovery in European mobile, and reiterate our Buy rating / 250p target price."

Citi expects sales of £42.3 billion in 2015 and £6.9 billion of pre-tax profit, giving earnings per share (EPS) of 7p. At 218p, Vodafone shares trade on 31 times forward earnings, a premium to rivals, and a 6.4 times EV/EBITDA ratio.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.