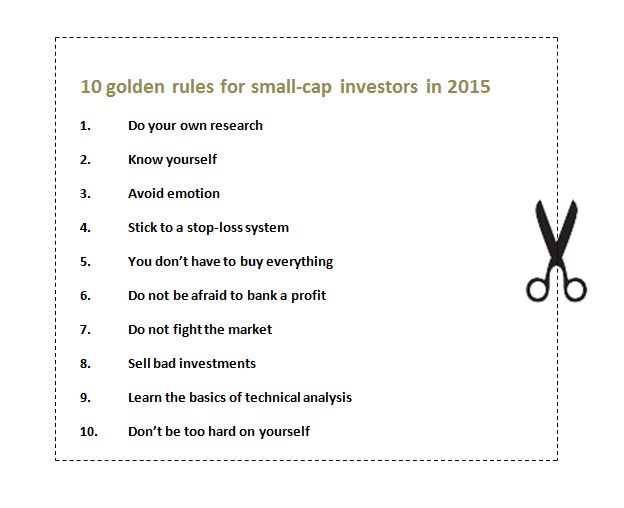

10 golden rules for small-cap investors in 2015

26th December 2014 00:00

by Lee Wild from interactive investor

Share on

Investing in small-cap shares can be an incredibly rewarding experience, both financially and intellectually. The thrill of identifying a potential winner which has so far eluded the radar of fellow investors is hard to beat. When the crowd finally cottons on, all you have to do is sit back and watch the price tick up.

Of course, it's wonderful when everything clicks into place. But it's not always quite that simple. However experienced an investor one thinks they are, there is always room for error. That's why we've put together a simple checklist for all investors in small-cap shares to help avoid, or at least limit, your trading mistakes.

Cut out and stick on the side of your PC/laptop/tablet

1. Do your own research - this can mean anything from acting on a newspaper share tip to carrying out your own forensic analysis of company accounts. Most of us fall somewhere in between. But it certainly pays to do as much background work on an investment idea as you can. You may have your favourite financial pundit, or investment system, but always check in more than one place. At least then you have done everything possible to increase your chance of success and minimise mistakes.

2. Know yourself - There are investors and there are traders. Don't get the two confused. Investors will stick with quality companies for the long-term, while traders will be comfortable buying and selling shares far more frequently, typically taking a smaller profit over just weeks, days, or even hours. Decide which one you are and stick to those principles. Don't try and be something you’re not. That said, even traders need longer-term investments and ought not to be trying to trade everything all the time.

3. Avoid emotion - becoming emotionally tied to a particular stock can be dangerous. In fact, it is one of the most common reasons why investors lose money on small-cap trades. However much you come to like a company, an investor must not lose sight of the overall picture, or be disabled by blind faith.

4. Stick to a stop-loss system - it's never nice to lose money on an investment, but if a trade is going wrong you can at least limit the damage. You can tweak your stop-loss system to suit yourself. Many investors set their sell price at about 20% below their buy price, others at 10%. Whatever you decide, you're capping your potential loss. One tip is to avoid setting it at a technical level from which the shares might then bounce. The beauty of this system is that it preserves profits, too. Remember that the stop loss should move up in line with the share price, penny for penny.

5. You don't have to buy everything - AIM is home to over 1,000 companies, and there is good value to be found. But there is a danger of over-exposure to what are typically higher risk stocks. AIM companies also tend to feature heavily in tip sheets and in the financial press. But these should be used as a source of ideas, and not as gospel. Every investor has different objectives and few existing portfolios are identical. They might not be right for everyone. Equally, if a share price rockets, do not chase it higher. There are plenty more fish in the sea.

6. Do not be afraid to bank a profit - selling shares is harder than buying them. The prospect of seeing your investment idea turn a profit is a thrill, but deciding when to call time can be a real emotional rollercoaster. It shouldn't be. If you're happy with what you've made, there should be no recriminations. If the shares keep rising, your original idea is further vindicated. Think of it as leaving something for the next man

7. Do not fight the market - investors lost out in 2014 by sticking with badly-hit shares like , and Blur (BLUR). Whatever the reason for their demise, and whether or not you agreed with the thinking behind it, it's important to know when you're fighting a losing battle. Know which way sentiment is heading and don't swim against the tide. There will be a time to buy, but make sure the rout is over first!

8. Sell bad investments - similar to the above, but this relates more to investment decisions you make that just aren't working out. Clearly, this requires admitting a mistake, which can be an uncomfortable experience. A share price doesn't have to fall much to make it a bad investment. It could be that a company is just not fulfilling its promise, whether it is down to weak markets, or poor management. If it looks terminal, try again and put your money somewhere with better prospects.

9. Learn the basics of technical analysis - It will not necessarily work for smaller, illiquid stocks, but it's very easy to grasp, and knowing how to draw a trend line or identify support and resistance levels is another string to an investor's bow. It also helps the canny investor develop discipline and identify both entry and exit points.

10. Don't be too hard on yourself - face it, not every trade will work. Whether swift and savage, or slow and painful, sometimes you'll lose money. Even the greats don't get it right every time, think Warren Buffett and Tesco! But rather than self-flagellation, investors should instead learn from their mistakes. Think about, or write down, why you made the investment decision, then work through and discover where you went wrong. Tweak your strategy to limit the chance of repeating the error.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.