Broker demolishes housebuilder 'buy' case

9th January 2015 11:56

Most of Britain's housebuilders have seen share prices surge by five-fold since 2010. Some have done even better, partially recouping losses suffered during the crash of 2007/08. A huge boom in demand for homes since the credit crunch is outstripping supply, and a re-rating was inevitable. A decision to extend the Help to Buy scheme by another four years to 2020 underpinned demand. But broker Jefferies thinks the good times are over, and takes 133 pages to explain why.

"We believe that negative newsflow on UK mortgage approvals, UK housing transactions, weak house price data and lower UK GDP growth will lead to share price weakness in the UK residential sector in Q1 2015, and that uncertainty around the UK general election in May will see this weakness continuing into Q2," it says. "As a result, we are no longer recommending that investors buy any of the UK residential-linked shares under our coverage."

House price weakness in the wider market will negatively impact the UK housebuilders, reckons the broker, and sector valuations - a one-year forward price-to-book ratio 1.6 times - look full and will be hard to maintain given the housing transaction and election headwinds. "Given the challenges ahead we would not advise buying any shares in the UK housebuilders at this time."

"We are therefore making a rather bold call and do not expect the 'usual' outperformance in Q1." That is bold, given the sector share price index has improved in 22 of the last 29 years, with an average return of 11% over the three months. has risen in 16 of the last 17 years since its IPO, and generated an average return of 13%.

"UK housing supply is towards the top of the policy agenda for all the major UK political parties, so we view the political risks as minimal. However, housing transactions typically slow in the lead up to an election and we believe that this softening of the market will weigh on the performance of the shares in the sector. We recommend taking profits in the first half of 2015 and reassessing valuations after the election in May."

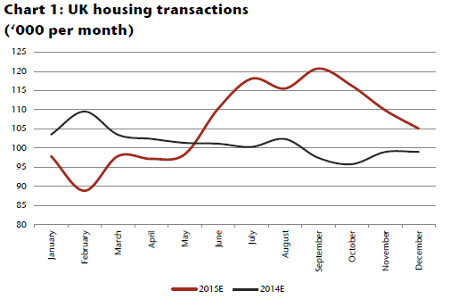

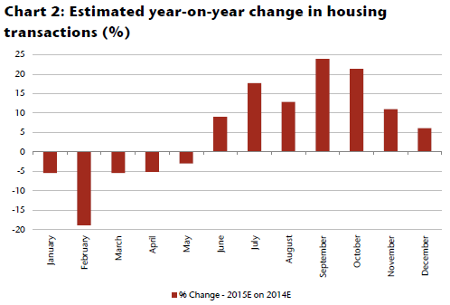

(click to enlarge, source: Jefferies)

Not everyone agrees with Jefferies. We recently rounded up the City's view on the sector and ran an article from Simon Thompson at Investors Chronicle which recommends the first quarter strategy spelled out by Jefferies above.

And just this week, Simon has reiterated his positive stance on the nine housebuilders which have all outperformed the market since he suggested buying the shares.

| Company | Closing price on 24 Nov 2013 (p) | Latest bid price on 5 Jan (p) | Share price gain (%) |

| Galliford Try | 1150 | 1264 | 9.8 |

| Crest Nicholson | 356 | 388 | 9.0 |

| Redrow | 270 | 291 | 7.8 |

| Bellway | 1829 | 1932 | 5.6 |

| Persimmon | 1495 | 1578 | 5.6 |

| Bovis | 832 | 874 | 5.0 |

| Taylor Wimpey | 130 | 136 | 4.6 |

| Barratt | 450 | 464 | 3.1 |

| Berkeley | 2459 | 2502 | 1.7 |

| Average | 5.8 | ||

| FTSE All-share | 3591 | 3508 | -2.3 |

| Sector outperformance | 8.1 | ||

| Source: Investors Chronicle | |||

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks