UBS names new Top 20 small-caps

14th January 2015 08:56

by Lee Wild from interactive investor

Share on

European small-cap shares did well in 2014, better in fact than their large-cap cousins. With the euro weak, cheap financing and structural macro reforms they should do well in 2015, too, despite an emerging market slowdown and political risk, so says Bosco Ojeda at UBS who has just named his current Top 20.

"In our view key metrics such as valuation, growth prospects and M&A prospects are supportive for European smallcaps," writes Ojeda. "European midcaps trade on 14x PE 2015e; we expect 12% EPS growth 2015E but would interpret any growth positively."

Encouragingly, small-cap operating margins at 6% are almost half the peak of 11% achieved in 2007, while return on capital employed, currently 11%, has previously peaked at about 20%. And with corporates sitting on substantial cash balances, a combination of healthy balance sheets and cheap debt financing should support increasing merger and acquisition activity, adds Ojeda.

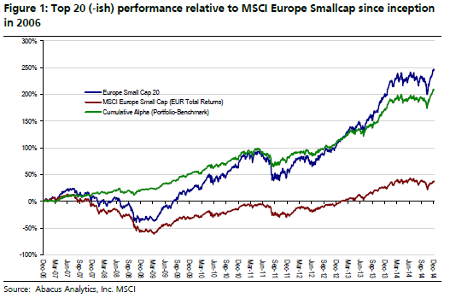

And it's certainly worth listening to what UBS has to say. The list grew by 14% in 2014, outperforming the MSCI small-cap index by 8%. Since inception in December 2006 the Top 20 is up by 266%, outperforming the small-cap index by 226% with similar volatility.

There are three new ideas to start the new year, among them UK firm , a maker of electromagnetic interference shielding materials used to stop smartphone or tablets overheating and interfering with other devices. is among its biggest customers.

Its shares moved sideways for most of last year while other Apple suppliers re-rated. That's why UBS recently upgraded its rating to 'buy' with 355p target price.

"We believe the company will continue to see a strong earnings and revenue expansion in 2015E based on 1) The fruition of the company's creation of manufacturing in Vietnam which should help it penetrate Samsung further 2) Strong iPhone shipments continuing 3) The likely benefit over time of multiple antennae technologies (MIMO) penetrating mobile devices and infrastructure more fully," says Ojeda.

With a forward earnings multiple of just 12 times estimates for 2016 and a 5% dividend "the valuation looks undemanding."

Laird joins other UK-listed plays on the UBS hit list, among them protective clothing-to-hospital linen firm , property company , heat treatment expert , Argos-owner and , a maker of kitchen cabinets.

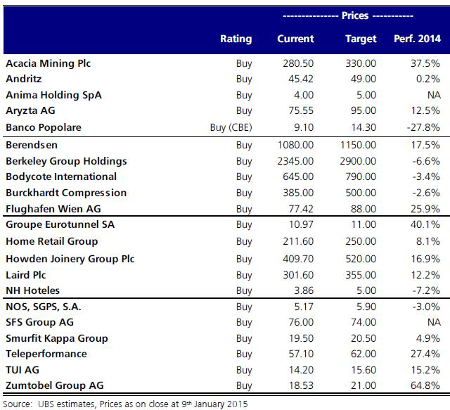

Here's the full Top 20:

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.