The Insider: City deals uncovered

23rd January 2015 09:28

Shanta Gold steady after huge share sale

shares traded at a five-year low earlier this month. This time in 2013 they were worth twice as much. But a recent production update was largely positive and demand for the stock has picked up.

In the final three months of 2014 gold production fell to 19,097 ounces, although that was in line with guidance. Full-year output of 84,028 ounces was better than the 80,000-83,000 predicted and up 31% on 2013. Gold sales of 24,700 were a record and Shanta received $1,253 per ounce. This year the company expects 82,000-85,000.

"A reasonable result on a quarterly basis leading to the company staying within full year guidance," said Investec Securities. "Longer term we look toward work on mine life extension at New Luika and the development of Singida to drive value."

Non-executive director Luke Leslie, also head of metal and mining at a natural resources private equity company, sold 3.26 million Shanta shares worth almost £347,000. However, the 33-year-old and the Leslie family "remains long term investors in Shanta Gold," the company said.

Clearly the sale has had no detrimental effect on the shares, and directors have been regular buyers since the summer. Non-executive chairman Tony Durrant last month bought 100,000 shares at 8.75p after buying 200,000 at 9.75p, 100,000 at 10.2p and 100,000 at 11.88p before that. Non-exec Robin Fryer bought 120,000 at 10p and chief executive Mike Houston 100,000 at 9.65p.

Shanta's 10-year stockmarket history has been a volatile one, but at least its chiefs are backing the business with their own cash.

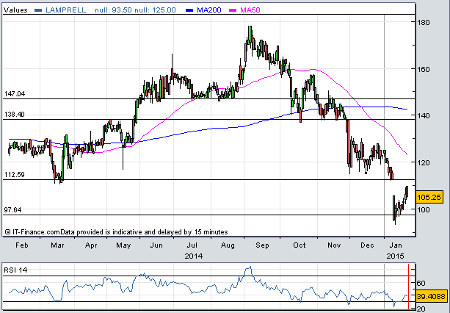

Lamprell warning no deterrent to buyers

A plunge in oil prices sent shockwaves around the industry and its suppliers. As the producers cut investment in new wells, demand for rigs and other support services has fallen. That's bad news for oil rig manufacturer .

Predictably, a trading update on 12 January carried with it a profits warning. Management now expects revenue for 2015 to be around 10% below current expectations, and for profit to miss forecasts by "a similar order of magnitude, with a heavy weighting towards the second half of the year due to the phasing in the construction cycle."

Lamprell is no stranger to profit warnings. In 2012, the UAE-based firm issued four of them amid supply chain issues. The shares fell over 80% from high to low. There was controversy, too, as directors Kevin Isles and Scott Doak sold stakes worth £904,000 and £727,000 respectively just a fortnight before the May profit warning.

But bosses are in buying mood again, perhaps a hint that they have been over-cautious in their latest missive. This week we were told chairman John Kennedy bought 64,439 shares worth £64,439 on 16 Jan and three days later picked up another 22,977 shares worth £23,087.

Earlier this week, we heard that HR and admin head John MacDonald recently bought 19,185 at 100p each and deputy finance boss Tony Wright opened his account with 40,000 shares worth £40,702. A strong balance sheet, net cash of $275 million, and a high backlog is reason to be confident, although it remains unclear quite how severe the downturn will be.

"Lamprell should be OK, it has a yard full of profitable business and a strong order book from highly reputable clients but especially with its recent history, albeit under previous management, there are no prizes for sticking ones neck out at this point in the cycle," says industry expert Malcolm Graham Wood.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks