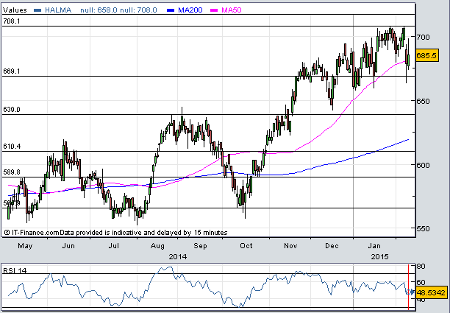

Has Halma had its day?

10th February 2015 17:08

by Lee Wild from interactive investor

Share on

has been growing steadily since the financial crisis, something reflected in a share price up almost five-fold. And the maker of smoke detectors and automatic door sensors has impressed again, reporting constant currency growth in all four divisions during the second half and a weaker-than-expected foreign exchange headwind of just 2%.

Ahead of full-year results on 11 June, management said it expects adjusted pre-tax profit of £145.6-£156.5 million, in line with expectations. First half trends continued into the second half of the year, with organic constant currency revenue growth in all regions and order intake just ahead of revenue.

Previously a drag on profits in the first half, Halma has shaken up its Environmental and Analysis business, which is now trading in line with last year. Second half revenue in 2013 was about £84 million and profit £17 million.

"Halma's end markets are diverse and their growth rates vary, but most are regulated by stringent safety standards or are driven by demographic trends, which are resilient," explains Michael Blogg, an analyst at Investec Securities.

Concerns about the company's 11% exposure to the oil & gas sector appear overdone, too. It's very well spread and there's unlikely to be any relaxation of safety standards in hazardous applications. Blogg expects progress elsewhere to offset any softness in oil & gas.

Despite this, Blogg has cut his target price for Halma by 3% to 690p and switched his recommendation from 'add' to 'hold', reluctantly, it seems. "Our estimates are close to consensus, with earnings unchanged, and only the de-rating of some sector peers brings our target price down," explains Investec.

His decision comes a day after JP Morgan expressed concerns about a potential slowdown in organic revenue growth this year to 3-4% during the next few years from 6% over the past decade. "We believe a premium rating is deserved but see the current premium as too large and, as such, unsustainable," says the broker, repeating its 600p target price.

But Scott Cagehin at rival Numis Securities disagrees, and still thinks the shares are worth 745p.

Halma has proved resilient through the economic cycle with demand driven by increasing health, safety and environmental legislation. Many of its products are sold into highly regulated markets characterised by non-discretionary spend and lower sales cyclicality. The shares are trading on an annualised 2015 PER of 21.2x (23x at time of publishing) falling to 20.0x in 2016, a justified sector premium given its positive order momentum, defensive characteristics and strong balance sheet.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.