Afren default a possibility

16th February 2015 13:06

The share price of troubled oil explorer continued to fall on Monday after it decided to terminate takeover discussions with Nigerian oil company Seplat late last week. The takeover prospect had been supporting the group after a string of bad news, and unless it can find another company to acquire it, the company could default, says one analyst.

Seplat had requested another extension to Friday's 5pm deadline to decide whether it would make a firm bid for the explorer. Afren refused, saying that it had not yet received a satisfactory proposal, suggesting that the value was significantly lower than the value of its debt. The deadline had already been extended from 30 January to 13 February.

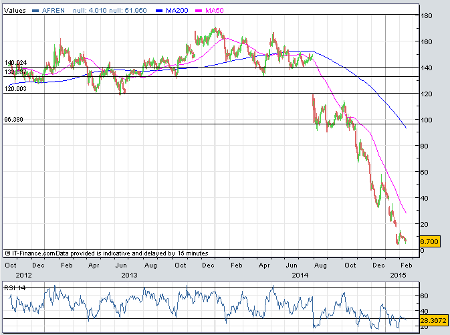

After initially falling to 4.8p after the news on Friday, the oil E&P firm's market value had recovered to 8p by close of play. Clearly, investors had a long think over the weekend and its share price was down by around 4% to 7p, 0.7 times forward earnings this morning. Over the last year, Afren has lost 95% of its market value in a bear raid that began with the suspension of its management for illegal payments - which later led to the firing of its CEO and COO - and saw it slash its Barda Rash oil estimates in the Kurdistan region of Iraq at the beginning of the year. None of this was helped by the collapse in oil prices.

Management are talking to its largest bond holders regarding the immediate liquidity and funding needs of the business and are looking at recapitalising the company.

But Marc Anis-Hanna, an analyst at VSA Capital isn't so sure. "One way out for Afren would be to find another company to acquire it. Otherwise, I think Afren might just default without being able to repay its debt. Value is now close to zero so an equity recapitalization wouldn't be sufficient."

African banking group Ecobank still reckons Afren looks attractive, however, as other companies in Nigeria eye up its assets in the region.

"Given the low pricing of the company shares and recent operational and corporate challenges, the company's valuation is likely to remain attractive. Some of the key Afren's assets likely to attract buyers include the Ebok field, which is a low cost producing field onshore Nigeria and a stake in the offshore OPL 310, in which Afren made the third largest global reserve discovery in 2013."

Since Seplat recently secured funding of $1 billion, Ecobank reckons it could still come back with another offer within the next six months.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks