Big upgrade for UK property plays

19th February 2015 13:03

by Lee Wild from interactive investor

Share on

The inevitable increase in UK interest rates has been the subject of much speculation for many months now. It's threatened to cap any further rise in property prices and growth in net asset value (NAV) for UK real estate plays is expected to slow this year. However, alterations to certain assumptions have convinced the team at Societe Generale to turn bullish on the sector's two big hitters.

A clear catalyst is a dramatic cut to inflation estimates from 2.3% to 1% in two months. Add in uncertainty ahead of the UK general election, and low rates are likely here for longer, which should spell good news for the real estate sector, reckons SocGen.

"Visibility of the short term is very good: strong NAV growth, a lack of liquid alternatives and global disinflation should drive additional (new) liquidity into this continually under-represented asset class, particularly in listed real estate after three years of outperformance," it says.

"Given strong take-up and investment volumes, low vacancies and continued downward pressure on prime yields, we expect the UK real estate market to outperform Europe in the first half of 2015."

Recent gains on the continent fuelled by a massive programme of Quantitative Easing (QE) switches attention to the UK where property total returns (change in NAV + dividend yield) could hit 20% this year compared with just 8% in continental Europe. And SocGen has raised UK target prices for the sector by 20% on average by discounting the impact of lower bond yields - now 2% by December 2015, instead of 2.9% previously.

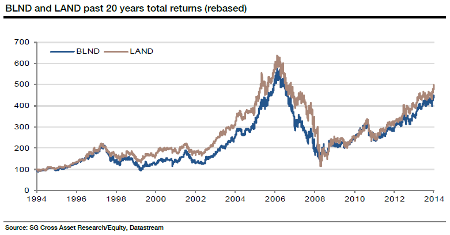

Both and are now expected to deliver a total return of about 9-10% per annum over the next three years, much as they have over the past 20 years. "On the back of lower rates and our new capital recycling scenarios we raise our target prices by 27%."

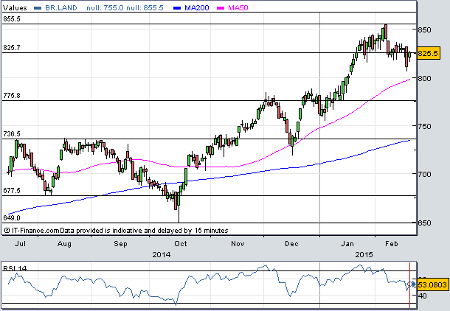

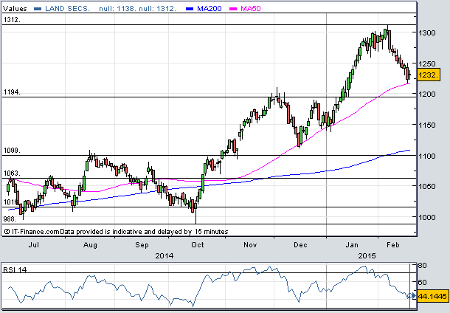

The broker has upgraded both stocks from 'hold' to 'buy' and ups its target price on British Land from 810p to 1,030p, and for Land Securities from 1,260p to 1,600p.

"For British Land, we see returns feeding through from their higher financial leverage throughout the cycle as well as from new income streams from development assets coming to market," writes SocGen. "This compares to Land Securities, where we see stronger operating leverage through capital rotation that is beginning to transform its portfolio, particularly in the retail space."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.