Who will be next to cut the dividend?

20th February 2015 16:23

by Lee Wild from interactive investor

Share on

Company earnings have recovered dramatically since the last round of major profit downgrades in 2009. A lot of cost-cutting and a return to economic growth in major global economies helped, and falling input prices and rising wages are fuelling further growth. Shareholders have been rewarded handsomely, both in capital growth and substantial increases in dividend payouts. But one analyst believes there are storm clouds on the horizon, and that returns have now reached unsustainable levels.

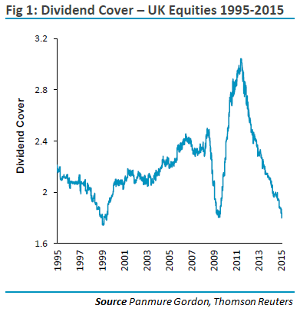

"Twelve month forward dividend cover across UK equities has fallen to levels last seen in 1999 and 2009 (Fig 1) - both these episodes were off the back of severe earnings downgrades," explains Simon French, senior UK economist at Panmure Gordon. "Should equities face a similar challenge in 2015 the starting point for income stocks is now worryingly weak."

"Recent cuts to the dividends on offer in the Oil & Gas and Food Retail sectors should alert investors to the precarious nature of some of the pay-outs now being offered."

It's true, there have already been some high-profile victims. , and are perhaps among the most notorious. But how can investors identify companies which may follow suit?

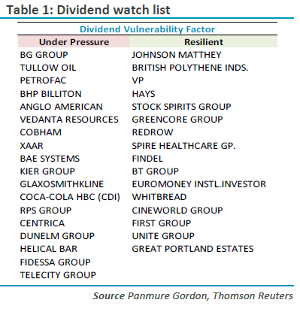

Well, French has come up with a measure of dividend vulnerability - a gauge of income sustainability to an earnings downgrade - broken down to individual stock level, measuring the ability to protect shareholder returns should earnings disappoint in 2015. His analysis also shows the companies where dividend sustainability is at its most acute. (Table 1).

Panmure believes that the likelihood of a rise in US interest rates in the second half of 2015 and resultant currency stress on emerging markets, plus "worsening deflationary vortex" in the Eurozone could herald the return of more volatile trading conditions.

"Dividend pay-outs are stretched both historically and within the current cycle," says French. "We encourage investors to challenge the resilience of forward income assumptions in their portfolio," he adds, warning that oil, gas, basic materials, utilities and telecoms are most vulnerable to dividend cuts.

Of course, the assumption here is that company earnings will come under serious pressure in 2015. They may do, for there are many potential banana skins on which both the global economy and individual companies could come a cropper - pick from Greece, Ukraine, China, Middle East.

Right now, however, there is little sign of a serious, or prolonged, threat to current EPS forecasts outside of problem sectors like oil and the supermarkets. But even here, there is some resilience. Remember, hasn't cut the payout since World War II, and many other blue chips have made a commitment to either grow or at least maintain dividend payments for the next year or two.

Check out this recent article to discover our favourite income stocks.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.