FTSE 100 - party like it's 1999

25th February 2015 08:42

by Lee Wild from interactive investor

Share on

So, Tuesday 24 February 2015 goes down in history as the day the FTSE 100 made a new high - 6,958.89 for the record. It's just a number though, right? Well, yes, but this has been a monkey on the back for 15 years, and the relief in the Square Mile is palpable.

Last time the index was this high - its previous best was 6,950.60 on 30 December 1999 - the euro was less than a year old, experts were predicting the Y2K bug would destroy civilisation, and Manchester United were still capable of winning the Premier League.

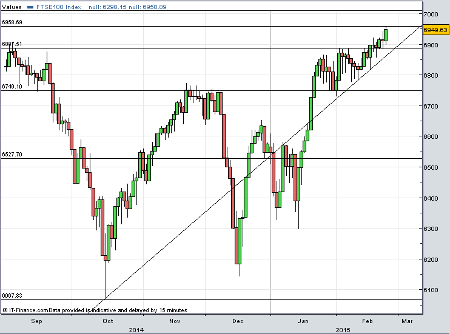

But there's a serious side to this major milestone. Breaking out above previous technical resistance at around 6,887 could pave the way for substantial gains (see chart). Since the Dow Jones made a new record early in 2013, the index is up over 26%. The German DAX index has rocketed over a third after hitting a new mark shortly after.

Clearly, a short-term rally in London appears more likely now, and 7,000 is the big figure to aim for. It's achievable, too, and more.

"With Greek reforms having staved off a potential crisis for the near term, and the weight of liquidity and lack of alternative options also driving people towards equities, investors will be hoping that the index can sustain its momentum and go through 7,000 and beyond," says Rebecca O’Keeffe, Interactive Investor's head of investment.

Interestingly, it was the bombed-out mining sector which was responsible for getting the ball over the line this time. Better-than-expected half-year results from - up 6% - carried peers , , , and higher. In fact, the first five are among the best performers over the past month - up 15%, 12%, 10%, 18% and 11% respectively. But it was stunning performances by the likes of , and a resurgent in the past few months that teed up the index for the final push.

Of course, this bull market has lasted longer than the average and, despite ECB president Mario Draghi's €1 trillion-plus "bazooka", there are issues which could make the UK rally a brief one, not least the General Election in May. Problems could easily blow up in Greece, Ukraine, China, or the Middle East, too.

There will be a time to sell, or at least take some profits. For now, however, investors will be reluctant to cut exposure to equities and risk missing out on further upside.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.