Nine funds to give you a £10,000 annual income

12th March 2015 09:26

by Heather Connon from interactive investor

Share on

Income is a priority for many investors, particularly those no longer earning: you can buy your lunch with a dividend, whereas spending a capital gain means you have to sell the investment first. But income, and particularly sustainable growing income, is hard to come by in this era of prolonged low interest rates, rockbottom bond yields - ith the threat of a bond market crash once interest rates start to rise - and the risk of dividend cuts on the stockmarket. In this climate, generating a £10,000 annual income could require as much as £300,000 of fund investments.

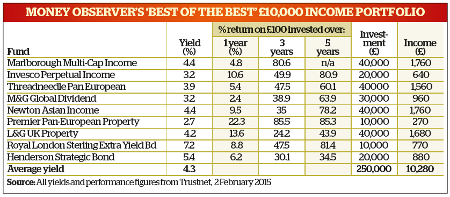

But do you really need that much? Below, we outline suggestions from a number of experts, highlighting the range of approaches it's possible to take, and draw from them to put together a targeted Money Observer portfolio of best ideas.

Our advisers have selected many of the more popular income funds for their portfolios. For Money Observer's own portfolio, we have sprinkled some less well-known funds among familiar names. The aim was to select funds that not only provide a decent level of income but have a good track record and highly rated managers.

We have invested across a range of assets and regions, including property, bond and equity funds from across the world. The portfolio includes a mixture of funds with a relatively high yield, balanced by some with a lower income, to provide a balance of risk and reward.

Investors should, however, bear in mind that the income on these funds is not guaranteed: companies can cut their dividends, while bond issuers can renege on their payments - and even some governments have been known to do that in the past. But using funds for the portfolio means that risk is spread across a range of investments, which should, therefore, mean that dividend cuts or defaults will have less of an impact on overall performance than a portfolio composed entirely of shares.

Just as income can rise and fall, so too can capital values; and while income-based strategies have been shown to produce good results over the long term, there is a risk of capital losses over the short to medium term. Income investors should also be aware that dividends are a key part of the total return on an investment, so spending rather than reinvesting the income will have an impact on overall returns.

Money Observer's two UK fund choices have markedly different strategies from the general run of UK income funds. , run by the much-admired Giles Hargreave, aims for an attractive and growing income from a diversified portfolio of UK assets. It has a small- to mid-cap bias, with top 10 holdings including , and .

At the other end of the spectrum is . This fund has been rather overshadowed by the fanfare that welcomed the launch of the new fund from its former manager Neil Woodford, but Mark Barnett, who took over the Invesco fund from Woodford, has an excellent reputation. In contrast to the Marlborough fund, this fund has a heavy large-company bias, with seven of the top 10 from the FTSE 100 and two from its international equivalents.

Europe's stockmarkets have underperformed recently, as stuttering growth and the threat of deflation have been exacerbated by renewed concerns about the prospect of Greece triggering a break-up of the euro. Many of its companies, however, remain in good health and are offering attractive yields. For exposure, we have opted for , which can also invest in the UK.

, while not a particularly high-yielding fund, looks for companies with long track records of growing dividends, so the yield should be relatively secure and have the prospect for growth. is the obvious choice for dividends in Asia. Additionally, we have opted for two property funds - the rather low-yielding because of its good growth record, and , which has managed to avoid locking investors in during market turbulence.

We have also chosen two bond funds, and - the former for its high yield and strong track record, the latter for its ability to invest anywhere, which may provide a cushion against a market tumble. But we have kept our investment in fixed interest relatively low, as we are nervous about the prospects for bond markets when interest rates start to rise - which could happen in the US later this year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.