Highly-rated Betfair smashes forecasts

5th March 2015 12:46

by Lee Wild from interactive investor

Share on

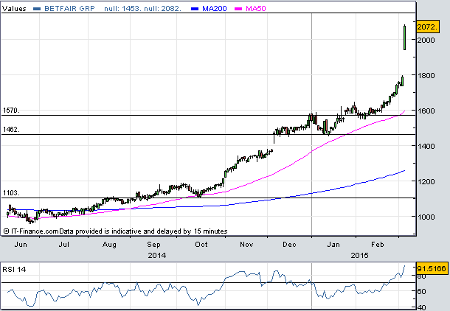

rally since July last year has been nothing short of meteoric. In that time, the share price has more than doubled, despite new UK tax rules on gambling, and now the internet betting exchange has smashed third-quarter profit forecasts and upgraded guidance for the full-year.

Ahead of next week's Cheltenham Festival, Betfair revealed that cash profit surged by 17% in the three months to 31 January to £23.6 million. Add back a £7 million hit from two months of the new UK point of consumption (POC) tax, and profit would have risen 51%.

Chief executive Breon Corcoran now thinks Betfair will make a cash profit of £113-£118 million in the year to 30 April 2015. That's about 12% ahead of consensus estimates of £103 million.

Revenue rose by a fifth in the quarter to £114.6 million, the fourth quarter of double-digit growth in a row. Revenue from sustainable markets (UK, Ireland, US, Italy, Denmark, Malta, Spain and Bulgaria) jumped by 27% to £92.9 million - the US leapt by a quarter at constant currency to £13.5 million, much faster than expected.

Sports revenue grew by16% to £76.7 million, although the standout performer was the gaming business where revenue growth of 30% to £24.1 million followed 43% growth in the second quarter. The number of active customers in sustainable markets was up by 50% to 638,000, and by 35% to 760,000 overall.

And there's little sign of things slowing down, either.

"We are entering one of the key periods in the sporting calendar and are focussed on finishing the year strongly," says Corcoran. "Beyond that, we are set for record levels of political betting around a closely contested UK General Election."

But Betfair needs to maintain this kind of growth to justify sky-high valuation multiples. Its share price surged 16% on these Q3 numbers to 2,072p. But even on last night's close of 1,786p, JP Morgan reckons they traded on 27.8 times calendar year 2016 EPS estimates. Even after stripping out £55 million of net cash, it was 26.9 times.

"This is well ahead of its average since the Oct-10 IPO of 19x, but as we believe that Betfair is now better placed than at any time since then we are comfortable with this peak multiple," says the broker. Even after applying a 30% premium to the gaming sector on 18 times forward earnings, Betfair's current rating is beginning to look stretched.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.