Is Fundsmith Equity overvalued?

6th March 2015 10:00

The most popular question at the Fundsmith Equity annual meeting was whether the fund, which has more than doubled in little over four years, is overvalued. Terry Smith answered in characteristic style.

I wasn't going to attend the annual meeting this year. I took my son along two years ago and one of the fund's many mantras is to do as little as possible. Trading increases charges, which decreases fund performance and the fund's strategy is to let the companies do the work. Fundsmith Equity focuses on a small pool of stalwarts - highly profitable companies it believes will remain highly profitable. It wants to share in their growth over the long-term rather than trade on the back of investor sentiment. So there probably wasn't much more to learn this year.

The fund's manager, Terry Smith, has a high profile, and the fund is good at communicating with investors. Like Berkshire-Hathaway, the giant US fund-cum-conglomerate run by Warren Buffett, which in some ways Smith's fund apes, Fundsmith Equity publishes an owners manual and writes an annual letter to investors. Berkshire too has an annual meeting. It's is often referred to as a pilgrimage and I suspect for some fundholders, Fundsmith's annual get together is becoming a pilgrimage too. There were 500 of us at the stately Senate House in London on Tuesday evening.

I feel well informed and not being the pilgrim type I was wary of hearing the same old schtick, but when I received my invitation, it came with a request to submit questions in advance of the meeting and I realised I had a question.

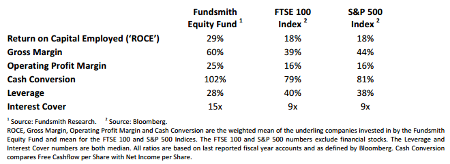

In its annual letter, Fundsmith Equity had provided a table showing what the fund’s financial ratios would be if it were a company, accounting for the stakes it owns in companies proportionally:

This is revelatory to someone like me, who mostly invests in companies. All I really want to know of the fund I invest in, is whether it invests in the kind of companies I would, if I could. The main reason I invested in Fundsmith Equity is that it owns shares in huge multinationals and my focus is on smaller companies. However, like Terry Smith, I recognise that long-term returns are driven by profitability, and I'm very sceptical of companies that require debt to produce it.

The table was missing only one statistic, because I share another goal with Fundsmith Equity: not to overpay. Conscious of the fact the fund has more than doubled in value in little more than four years and that since it barely trades, it must be invested in largely the same shares it held early on, I wanted to know the fund's earnings yield, ie how much the fund as a company is earning compared to the price of the fund now. I also asked:

- How has the earnings yield changed since the fund started?

- Is there a point at which the fund, or shares in it would be overvalued?

The matter of valuation was on other fundholders' minds too. Five others asked similar questions.

Smith provided the statistics. The fund’s focus is on cash rather than accounting profit, so the free cash flow yield of Fundsmith Equity is 4.5%. That is also a measure of return on investment at the current fund price. Since companies in the fund convert 102% of their profit into cash, the earnings yield is almost the same, 4.4%. It doesn't predict the return fundholders will receive in future, as that will also be influenced by how much the companies grow, but it is useful as a means of comparing one company, or one fund, with another (if more funds published such stats).

In 2010, Fundsmith Equity's free cash flow yield was 6.5% so the yield has dropped considerably over time, which means the shares are more expensive than they were. Bearing in mind Smith's mantra not to overpay, investors buying the fund now are paying more. He said he honestly didn’t know if the fund was overvalued but suggested investors look at the alternatives. The average free-cash flow yield of the market is lower - 4.2% compared to Fundsmith Equity's 4.5%. Since, in terms of profitability, debt, and cash flow, Fundsmith companies are better than average, in relative terms fundholders are getting good companies at attractive prices.

There is a wrinkle, and that is the earnings yield. The market's earnings yield is slightly higher than Fundsmith's, but that is simply because the cash conversion of other companies is 80% compared to Fundsmith Equity's 102%. It's a small wrinkle and free cash flow yield is probably the safer measure.

Smith says he will sell a share if it is overvalued, but generally that means it is overvalued relative to another share in his universe - the relatively small group of shares with common characteristics the fund favours. There are two other reasons to sell a share he says: if a company decides to do something "stupid", or if Smith was wrong when he decided the share should join the portfolio.

Anyway, he's buying. The partners in management group Fundsmith LLP, of which Smith is the biggest, have about £60 million invested in the fund, and Smith says he intends to add substantially to his investment this year.

The meeting was more useful than 2013's, the presentation more perfunctory, and the questions and answers more interesting. I hadn't intended to write it up, so my notes on other topics are perfunctory too, but Smith gave views in response to a wide range of questions:

- Brands, he said, are important, but not always enduring. Its better if they're the "final frontier" – attractive products provided by companies that have other advantages, such as control of supply and distribution.

- Executive compensation should be linked to profitability and growth, as growth alone can be fuelled unprofitably by debt. Sadly, companies still default to growth alone.

- Family control enables companies to make really long-term investments that ultimately prove to be highly lucrative. Fundsmith likes family control as long as it's combined with ownership. It disapproves of share classes that confer unequal voting power on founders.

For his views on whether the economy is doomed (probably not as much as fatalists say), ethical investing (impossible to satisfy everyone in a fund), an amusing take-down of a platform's explanation for not including Fundsmith Equity in its list of expert recommended funds (self-interest), and the team's reading habits (thousands of industry publications), you'll have to watch the video, which has yet to be published on the fund's website.

Next year I'll watch it, unless I have another question.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks