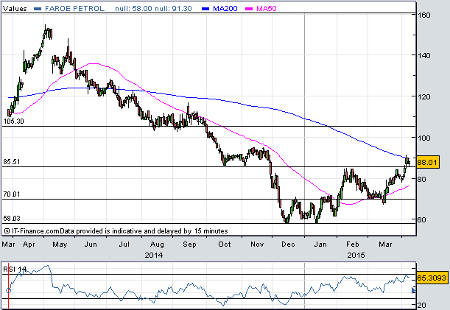

Faroe Petroleum still ticks the right boxes

10th April 2015 13:24

by Lee Wild from interactive investor

Share on

North Sea oil explorer Skirne East exploration well has encountered a net 10 metre gas column in the high quality Middle Jurassic Hugin formation. It puts the size of the discovery at 3-10 million barrels of oil equivalent (mmboe) - way below pre-drill estimates of 30-110mmboe, but promising nonetheless.

"We must be grateful for small mercies and that it is still a discovery," reckons oil industry veteran Malcolm Graham-Wood. "With nearby infrastructure and much cheaper costs, smaller discoveries like this are most definitely viable and in some cases pay-back is achieved pretty quickly."

Faroe's 20% interest in the well, operated by Total in the Norwegian North Sea, is 0.6-2mmboe.

"We are pleased to announce the result of the Skirne East well which, although smaller than predicted, is a promising discovery particularly in light of the nearby Atla field which was recently developed with reserves within the resource range of the Skirne East discovery," said chief executive Graham Stewart.

In the months ahead, attention will shift to the significant Pil discovery (Faroe 25%) on the Blink and Boomerang prospects, where Faroe plans to start drilling the first of two follow-up wells. There's also the Bister prospect to follow up on Faroe's recent significant Snilehorn discovery.

"Our Norwegian position is now one of the most significant of any UK independent E&P company and with our robust balance sheet, despite challenging market conditions, the Company is set for another exciting year in 2015," says Stewart.

Westhouse Securities, which earlier this week named Faroe among a list of possible takeover candidates “given their depressed valuations relative to their portfolios", still rates the shares a 'buy' with 135p target price.

"I'm staying with Faroe as I feel that the company ticks a number of the right boxes," says Graham-Wood. "It is fully funded for this year, largely controls its own destiny and management is of good quality and pro-active enough to take advantages of appropriately good deals should they come up."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.