The Insider: M&C Saatchi, Howden Joinery, Majestic Wine

17th April 2015 09:48

by Lee Wild from interactive investor

Share on

M&C Saatchi advertises bumper payday

bosses have shared a £9.6 million payday. Four founding directors, including Lord Maurice Saatchi, and finance chief James Hewitt, have sold a total of 2.9 million shares at 330p each.

Chairman Jeremy Sinclair, chief executive David Kershaw, and executive directors Saatchi and Bill Muirhead, each offloaded 692,934 shares worth almost £2.3 million. Hewitt, chief number cruncher for the past five years, trousered £423,000.

However, these share sales are not necessarily a green light for other shareholders to follow suit. These shares relate to share bonus schemes issued to the founding partners back in October 2010 and to the FD in January 2012. Both vested at the end of December last year.

Announcing the awards in January, Saatchi said: "The awards reflect the achievement of targets for both share price performance and total shareholder return conditions (TSR) - compared with the company's listed peer group. M&C Saatchi has outperformed these share price targets and ranked first among the 15 comparator companies for TSR."

Said Lloyd Dorfman, non-executive director and chairman of the remuneration committee: "Five years ago, in conjunction with our major shareholders, a remuneration scheme was devised that ensured the alignment of the interests of the management team and shareholders. These awards reflect the strong operational performance of the M&C Saatchi businesses which has led to the group's outstanding performance compared to its peer group in terms of total shareholder return."

Each of the four founders paid £97,250 to participate in the scheme with the share price at about 117p. In early 2012 the price was only marginally higher, but has since taken off and stands almost three times higher. The four also still own shares worth £13.6 million each.

Recent full-year results were strong and Numis Securities reckons its estimates could prove conservative. "We maintain our PBT/EPS forecasts at £20.0m/18.0p at this early stage of the year, though continue to see upside as we move through 2015," it says, downgrading the shares from 'buy' to 'add' following a strong run, but raising its target price to 408p.

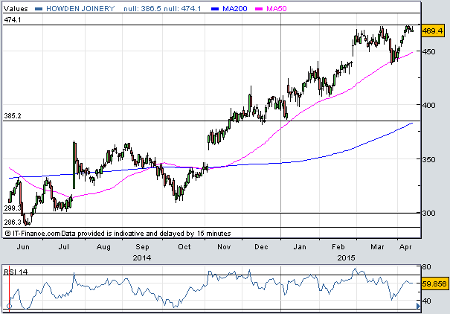

Heavy selling at Howden Joinery

Kitchen cabinet maker has surged fourfold in the past three years. At the beginning of January, our resident stockpicker Edmond Jackson said Howden was ripe for further upside. Days later, the company said full-year results would be better than expected.

"With the upgrade cycle apparently intact, there could be plenty more to come," we said. There was. Since then, the shares have risen another 13%.

However, deputy chief executive and finance boss Mark Robson has taken the opportunity to cash in. This week he sold 137,453 shares at 465p each, netting £639,000. His wife Rachael also sold 482,434 shares only days after Robson transferred 677,167 shares to her. At an average price of 462.8p, the Robson family bagged a further £2.2 million. Finance director Theresa Keating has also sold 128,054 shares at 470.3p

It's been a highly profitable few weeks for the Robson's. At the end of March, Mr Robson sold £1.9 million of shares after the 2012 company share scheme vested. Between them, they still own 1.85 million shares, currently worth almost £8.7 million.

Howden shares have hit resistance at around 474p, but broker Panmure Gordon still thinks they're worth 490p. Consumer confidence is high and Howden is opening more and more depots. Revenue jumped by 14% in 2014 to over £1 billion and operating profit by over a third. Net cash has swelled to £218 million, and a £70 million share buyback should help stimulate interest.

Majestic Wine's tasty deal

is buying online wine club Naked Wines for £50 million in cash plus up to £20 million of shares. Rowan Gormley, founder and CEO of Naked Wines will run the enlarged business; good timing coming as it does less than eight weeks after Steve Lewis stepped down.

Interactive Investor stockpicker Edmond Jackson ran through the acquisition earlier this week.

Majestic shares had halved since late 2013, and are still down over a third even after rallying 37% since news of the deal emerged.

Majestic chairman Phil Wrigley is backing the "transformational deal" with hard cash. He's just bought 10,000 shares for 356.5p each

"The acquisition of Naked Wines, the international online wine business, represents the sort of radical thinking we were hoping would come out of the strategic review and gives Majestic growth opportunities beyond the UK," says Investec Securities.

"We expect Mr Gormley to look to unlock Majestic's online potential, improve its CRM, leverage its store network distribution and moderate store roll out plans."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.