Goldman Sachs takes red pen to miners

17th April 2015 10:23

by Harriet Mann from interactive investor

Share on

Goldman Sachs has taken a red pen to its expectations for iron ore prices over the next three years, which has put the earnings potential for the heavyweight miners under threat. If they don't generate enough cash to pay out dividends, the broker warns that , and are not worth their premium valuations.

Chinese demand for steel has remained weak as the country continues to shift its focus away from investment-led infrastructure spending and towards reducing air pollution. In fact, demand is down 6.2% in the year to March 2015, according to Goldman.

To highlight China's contribution to global demand of seaborne iron ore, seven of every 10 tonnes will be taken by China by the end of this year.

There is enough supply from the Big Six to meet this lower seaborne demand with iron ore priced at under $40 a tonne FoB (Freight On Board/Free On Board), says the broker's equity research team. Rio, BHP, Vale, Anglo, FMG and Arcelor Mittal are expected to churn out 1.3 billion tonnes each year from 2016. As there is no upward pressure on price, these big firms can operate for lower returns which should save them in the short term.

Led by Eugene King, the Goldman Sachs team has cut iron ore price guidance to $47/$37/$33 (FOB Australia) in 2015/2016/2017 respectively and long-term (LT) 2015 real to $39 per tonne.

"We believe this will see EBITDA margins return to pre-2002 China super-cycle levels of c.30%-40% for the Tier 1 producers with associated cuts to earnings and free cash flow, ultimately putting more pressure on valuations for the iron-ore dominated names," say the analysts.

So, Anglo American and its subsidiary Kumba have been downgraded from 'neutral' to 'sell', BHP has been brought down a peg to 'neutral' and has been removed from Goldman's prestigious Conviction List. Rio's sell rating has been reiterated, too.

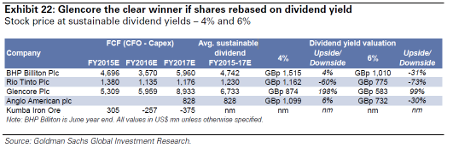

"Our main thesis for all is the same - we see an inability to cover dividends from FCF [free cash flow] on our commodity price deck, yet they trade at a significant premium which we believe is unwarranted."

On forward earnings, BHP trades on a multiple of 18 times, Rio 25, Anglo 17 and 22. On 2016 earnings, the iron ore miners trade on an average price/earnings (P/E) of 21 times compared to the market's 16. This implies investors see lower iron ore prices as temporary, but Goldman is convinced we have entered a sustained period of oversupply.

"Growth and cash flow are also important and we believe the high yields in the case of the miners simply reflect the miners' inability to cover dividends from cash flow and the relative lack of growth, rather than representing a buying opportunity."

Without any exposure to iron ore, Glencore has stepped up to replace outgoing BHP in Goldman's Conviction List. It's been upgraded to 'buy' from 'neutral' and its target price has been given a boost to 340p from 270p. It has higher exposure to Goldman's preferred base metals - zinc, nickel and aluminium - and its 2015 and 2016 dividend is safe, on Goldman's estimates.

We are in a period where China is changing and key commodities are in over supply, Goldman reminds us. Countries that rely on iron ore are more likely to up their taxes to cope with the lower income, more in-line with the oil industry. Oil companies pay between 50%-70% tax, compared to mining companies' current 35%-40% tax payments. Higher outgoings on already lower earnings are going to make life even tougher for the miners.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.