Resurgent Carpetright smashes forecasts

21st April 2015 12:33

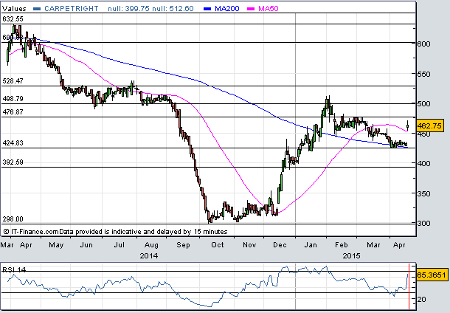

shares are up by about 40% since December when the carpet and floorings specialist reported rapid growth in the UK and a return to the black in Europe - half-year profit doubled. That momentum has continued through the final quarter and new boss Wilf Walsh reckons the company made much more than expected in the year to April.

Growth in UK like-for-like sales accelerated to 10.5% in the 12 weeks ended 18 April, up from 7.5% during the third-quarter. An early Easter certainly helped, but promotional activity and the introduction of an interest free credit offer are winning the firm market share, too.

In the Netherlands, Belgium and the Republic of Ireland, like-for-like sales grew by 2.4% - total sales fell 0.7%, and by 12.6% including currency moves. But with gross margin expected to have improved by 250 basis points, the division, which lost £3.8 million a year ago, should make money now.

Because of this, Carpetright now thinks underlying pre-tax profit for the year ending 2 May 2015 will be around £13 million. Previously, analysts had pencilled in just £10-£11 million.

"The group is well positioned to continue to grow market share and profitability, as we implement our plans to extend the appeal of the Carpetright brand," said Walsh ahead of results on 30 June.

"Not surprisingly, the introduction of credit is driving average order values and conversion and also leading more customers to take the 'complete package' of carpet, accessories and fitting," explains broker Peel Hunt, which upgrades estimates for 2015 in line with company guidance, and lifts profit forecasts for 2016 by £1.2 million to £16 million, giving adjusted EPS of 18p.

Peel Hunt analyst John Stevenson still believes the shares are a 'buy' and raises his target price from 500p to 525p.

"With a favourable macro backdrop and pent up demand across the home sector, we are generally upbeat about prospects for the home related retailers, notwithstanding the risk of any short term election risk," says Stevenson. "For Carpetright, however, this favourable backdrop is overlayed with an increasingly strong transformation story."

"[We] see a likelihood of more upside to come over the coming 12 months."

That seems a very reasonable assumption. Carpetright shares trade on a spicy-looking 26 times earnings estimates for 2016, but profits are expected to grow deep into double-digits and there’s every chance of further upgrades, too.

Of course, it will take time to implement Walsh's six-point plan - to tackle the perception of Carpetright as a "value" brand, introduce interest free credit, new ranges, improve customer service, freshen up stores, invest in a new website, and shut stores, renegotiate rents and introduce smaller "sample only" shops. But execution is going well, so far, keeping the turnaround on track, and the shares moving back in the right direction.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks