The Insider: ARM Holdings, Nichols

24th April 2015 12:32

by Lee Wild from interactive investor

Share on

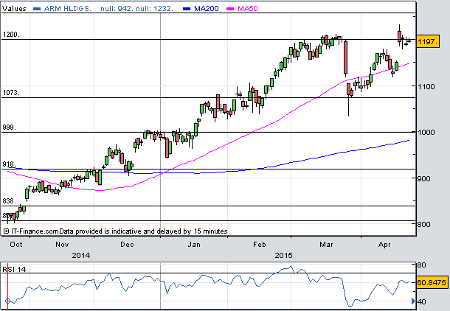

Hang onto ARM Holdings

Chairman Stuart Chambers rushed to buy more shares after the chip designer reported strong growth during the first quarter. On the same day that the company said three-month sales grew 22% to over £227 million and profits rose by a quarter, Chambers dug deep and trebled his stake in the Cambridge-based business.

Buying 20,000 shares at 1,204p each cost him more than £240,000 and took his total holding to 30,000, worth £359,000. Clearly, Chambers is confident that demand for ARM shares will match sales of its technology. Now at a record high, ARM shares have risen from just 90p in 2009 and are up 55% since last October.

Still, they continue to trade at a discount to historic levels both on a forward price/earnings (PE) and price/earnings to growth (PEG) basis. That's unjustified says Goldman Sachs.

"Our 12-month price target remains 1550p based on our royalty DCF [discounted cash flow], and we remain CL [conviction list] Buy given first quartile upside vs. EU Tech."

Numis Securities has just upgrade earnings forecasts, too, and thinks the shares are worth 1,350p. "The stock is still trading at the lower end of its 35-55x historic P/E range and there is a strong fundamental argument for further value creation as ARM technology is increasingly deployed to enable IoT [internet of things]," it says.

Nichols out of fizz?

is most famous for making the Vimto soft drink. It's been doing it for over 100 years and now produces other fizzy drinks like Panda, Sunkist and a new range from entrepreneur Levi Roots. Vimto is massive in the Middle East, a favourite of Muslims during Ramadan.

Run by the grandson of the original founder Mr John Noel Nichols, the company has thrived. Last year, it increased pre-tax profit by 14% to £25.7 million on revenue up 3.5% at £109 million. The share price is up six-fold since 2009 and has risen by nearly a third in 2015 to a record high.

However, current chairman John Nichols has begun selling stock, just a few weeks after last month's full-year numbers. At the end of March, he offloaded 17,060 at 1,180p. Two weeks later Nichols flogged another 30,000 at 1,190p followed by a further 30,000 at the same price this week. In all, the sales banked him over £915,000.

Skimming off some profits is a sensible thing for any investor to do, particularly after a strong run that now puts the shares on a generous 20 times forward earnings. The shares are nearing technical resistance, too, at around 1,235p. That said, Nichols still owns 2 million shares, or 5.4% of the business, worth almost £24 million and remains confident of further growth this year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.