BP profits slump, but dividend safe

28th April 2015 13:08

by Harriet Mann from interactive investor

Share on

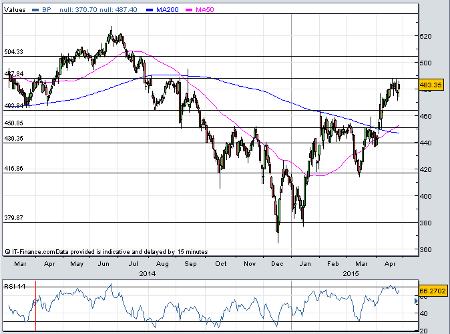

After kicking off one of the most important results season for some time, briefly led the on Tuesday as investors digested the oil major's success in adapting to lower oil prices. Rising as much as 3%, BP's share price is now up by about 17% this year, outperforming rival Shell by 23%. Yes, there is still much to do here, but the market appears confident.

BP's adjusted replacement cost profit shrank from $3.5 billion to $2.1 billion in the first three months of the fiscal year, and net cash generated from operating activities, including the charge from the Gulf of Mexico oil spill, was $1.9 billion versus $8.2 billion a year ago.

Downstream (refining) made $2.2 billion of underlying profit - twice as much as last year - which partially offset the plunge in upstream (exploration and production) profit from $4.4 billion to $604 million. That's down 86% on last year, largely down to the US, which slumped to a $545 million loss from a $731 million profit previously. Profit from its stake in Rosneft also shrank, down from $271 million to $183 million.

"The result for the first quarter reflected significantly lower liquids and gas realizations, and lower gas marketing and trading results compared with strong results in the first quarter last year, partly offset by increased production and lower costs," said management of the upstream business.

After previously raising $38 billion from its divestment programme, BP had earmarked another $10 billion of assets for disposal by the end of 2015. So far, nearly three-quarters of the new target has been reached, with sale proceeds during the quarter of $1.7 billion.

Low oil prices have forced companies to slash capital expenditure budgets. BP is no different, and its spend drops from $6.1 billion to $4.5 billion on an accruals basis - payments recognised as charged instead of when money actually changes hands. Lower costs were, however, partially offset by rig cancellation charges of around $375 million.

Total cash and equivalents stood at $32.4 billion at the end of the period, and BP announced a quarterly dividend of 10 US cents per share, the same as for the previous three months.

Chief executive Bob Dudley explained: "The dividend is the first priority within our financial framework and the board is committed to maintaining it, as we have today. We can sustain this by successfully resetting our capital and cost base and rebalancing our sources and uses of cash in the prevailing oil price environment. We will continue to review progress on this as we move through the year."

BP pumped 2.3 billion barrels of oil equivalent per day (boepd) in the quarter, up over 8% and significantly better than expected. Ramping up new major projects helped drive underlying production growth of 4%. It will be lower in the second quarter, however, with management blaming "seasonal" effects.

Augustin Eden, research analyst at Accendo Markets, reminds investors that the road to recovery will be long:

The strong refining performance has not only allowed the company to maintain its dividend payment but shows that BP is being proactive in dealing with the oil price slump by concentrating more effort away from expensive exploration and production activities. However, French oil major Total reported a similar state of affairs (a little better, even) this morning, indicating that what BP is doing is clearly not rocket science. There's still a lot of work to be done, and the path back up to previous levels of profitability will remain somewhat slippery.

Industry expert Malcolm Graham-Wood thinks the results are "perfectly reasonable" under the circumstances.

$2.58 billion beat the whisper comfortably and although there were a lot of funnies that can only be expected at the moment. Upstream was predictably poor but not dire and as I mentioned yesterday downstream did indeed show "a stronger environment" with refining margins in quite good nick. All the usual spiel such as ongoing divestment programme, resetting capex and addressing costs which are taken as read at the moment. BP has risen strongly so far this year and is a pound of the bottom having outperformed who have been punished for the bid by the market. With the Shell figures on Thursday we may have an opportunity to assess how things are going there and it may be the best place for loose change at the moment.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.