Shell profits plunge could have been worse

30th April 2015 13:06

by Harriet Mann from interactive investor

Share on

After years on the undercard, this results season is one for oil majors' downstream businesses. Low oil prices have crippled upstream earnings, but operations to refine and market the black stuff are, at least, offsetting some of the damage. has been punished for its £47 billion acquisition of - the shares have underperformed the sector by almost 9% since - but this update has restored confidence in CEO Ben van Beurden and his team.

First quarter earnings on a current cost of supplies (CCS) basis actually grew to $4.8 billion - up 7% excluding the impact of oil price swings. Strip out the benefit of $1.5 billion of one-off items - mainly disposals and a tax credit - and profit more than halved to $3.2 billion, or 0.52 cent per share. Last year, Shell took a net charge of $2.9 billion. This, however, was still comfortably ahead of consensus at $2.4 billion and Shell shares have responded well.

Like BP, downstream earnings saved the day. Underlying earnings soared by two-thirds at Shell to a better-than-expected $2.6 billion, supported by higher realised refining margins and lower costs. Upstream profit, meanwhile, crashed 88% to $675 million following the collapse in oil prices.

Van Beurden's divestment plan is clearly going well. It has already raised $1.4 billion, which eased upstream losses. And by adapting and delaying new projects, Shell has managed to drive costs lower and new capital investment in 2015 is expected to come in under $33 billion, $2 billion less than previous guidance. Nearly $6 billion was invested into the upstream business in the period and $849 million in downstream.

"Our results reflect the strength of our integrated business activities, against a backdrop of lower oil prices," explained Dutchman van Beurden. "Meanwhile, in what is clearly a difficult industry environment, we continue to take steps to further improve competitive performance by redoubling our efforts to drive a sharper focus on the bottom line in Shell. Part of this sharper focus is the sale of non-strategic assets. Asset sales total over $2 billion so far this year, as we successfully reduced our onshore footprint in Nigeria."

Shell managed to pump 3.2 million barrels of oil equivalent per day during the period, down 2%. Group cash flow from operating activities also halved to $7.1 billion. But management maintained a first quarter dividend of $0.47 per ordinary share.

Shell is making more bang for its buck, with the return on average capital employed up by 100 basis points to 7.1%. Management is also relying less on debt to finance the company, curtailing the proportion to 12.4% from 15.6% the year before.

"When BP reported earlier this week, we were surprised," explains Augustin Eden, an analyst at Accendo Markets. "But the fact is, everyone's got the same idea. The resilient oil majors have had the foresight and fortune to have gotten their fingers into the many pies of the energy sector while their smaller counterparts - the likes of - remain dependent on the more expensive, less profitable right now, and harder work exploration and production.

Pouncing on BG sparked speculation about a possible M&A frenzy. Many now believe it's simpler and cheaper to buy new reserves, rather than hunting oil down and drilling for it themselves.

"This idea, acted on by Shell last month, and subsequent shift in emphasis by the oil majors from upstream to downstream has proved interesting as a result," says Eden. "But if profits from refining and trading are rising, where's the oil actually coming from? More pressing, where will the oil be coming from in six months? What about a year's time? Will the oil majors give up on E&P altogether and simply 'buy' what they need from small- and mid-cap 'specialists'? Furthermore, will M&A mania bring fruit to its proponents? So far it looks as if the industry is shaking itself up. With Tullow reporting later today and tomorrow, will the trend continue?"

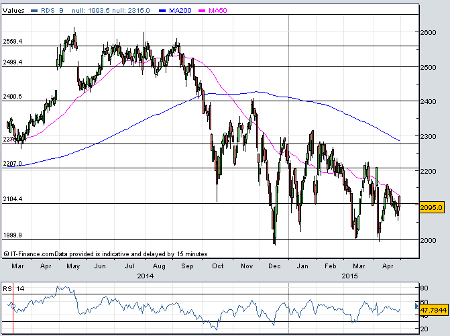

Life with lower oil prices is undoubtedly tough, but Shell, like BP, has a strategy to cope. However, a lifeless share price these past few months tips the balance in favour of Shell, in the short-term at least, according to industry expert Malcolm Graham-Wood:

"Overall I would prefer to be investing in Shell rather than BP given the recent performance of the two shares."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.