Our portfolios prove a massive success

8th May 2015 16:23

by Lee Wild from interactive investor

Share on

[Update: Register your interest for Interactive Investor's 2015 Winter Portfolios]

Six months ago we launched the Interactive Investor Winter portfolios. History told us that the shares we included should deliver market-beating returns. They did. In fact, our first pair of seasonal portfolios - a consistent basket of outperformers and a riskier, more aggressive portfolio - beat the benchmark FTSE 350 index by a huge margin, and provided a perfect springboard into our new Summer Portfolios.

As a recap, we wanted to take advantage of a seasonal trading strategy that typically generated far better returns than if you had stayed invested in the same shares all year round. Over the past decade, it has outperformed the FTSE 350 by at least five-fold. And it's incredibly simple, giving investors both a specific entry and exit date - buy on the first trading day of November and sell on 30 April.

We teamed up with Harriman House, publisher of The UK Stock Market Almanac, to find the five companies which had delivered the most positive annual returns over the past 10 years. That formed our Consistent Winter Portfolio.

Fine-tuning the data generated even bigger potential profits. Our Aggressive Winter Portfolio was more flexible on track record, but the extra risk is rewarded with potentially higher returns. This basket of shares still had at least eight years performance data and we picked only those which had risen between 1 November and 30 April at least 75% of the time.

And investor's faith in statistics would have paid off handsomely on this occasion. The Consistent Winter Portfolio returned 14% over the six-month period, while the Aggressive Winter Portfolio returned 16.9%, compared to a much more modest 8.7% from the FTSE 350.

Here's how we did it.

Consistent Winter Portfolio

| Consistent Winter Portfolio | TIDM | 10-yr Avg (%) | 2014/15 (%) |

| Croda International | CRDA | 17.6 | 23.5 |

| Ashtead Group | AHT | 36.7 | 7.9 |

| Regus | RGU | 30.2 | 26.5 |

| Henderson Group | HGG | 24.3 | 32.5 |

| Hunting | HTG | 22.8 | -20.4 |

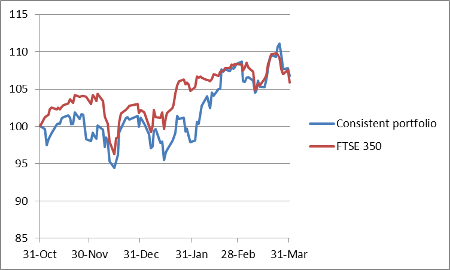

The Interactive Investor Consistent Winter Portfolio struggled during January and early February, largely due to huge losses at oil services provider . Its shares were down 46% at one stage after oil prices plunged to a near-six-year low. had a difficult time, too, and hard-won gains in the early months of the portfolio quickly evaporated. Despite the volatility, however, the industrial equipment rental company's three-year bull-run remained firmly intact.

If Hunting had traded only flat during the period, the portfolio would have been up18% come the end of April. However, the other four stocks more than made up for this disappointment and demonstrated perfectly the value of portfolio diversification.

Pick of the bunch was . The fast-growing fund manager overcame a blip in December to end the six-month period up by a third. Business was good last year and we were told recently that this strength had continued during the first quarter of 2015.

Heavy buying in the month before full-year results in early March was behind stellar gains at workspace provider Regus. A post-results sell-off was more than made up for with a knockout April. First quarter results revealed the company took full advantage of favourable market conditions.

Speciality chemicals company also featured among the star performers. The share price did exactly what was expected, growing steadily following a good run of quarterly sequential growth. Despite a pre-election market sell-off, the shares still ended the period up 23.5%.

And, of course, investors in the Winter Portfolios would also have received dividends from some of the constituents. A £1,000 investment in each of the consistent portfolio stocks would have generated £59.66 in dividend payments over the six months.

Consistent Winter Portfolio, Performance 1 November 2014-30 April 2015

Aggressive Winter Portfolio

| Aggressive Winter Portfolio | TIDM | 10-yr Avg (%) | 2014/15 (%) |

| Taylor Wimpey | TW. | 55 | 40.4 |

| Ashtead Group | AHT | 36.7 | 7.9 |

| Bwin.Party Digital Entertainment | BPTY | 30.9 | -6.7 |

| Playtech | PTEC | 30.6 | 16.4 |

| Regus | RGU | 30.2 | 26.5 |

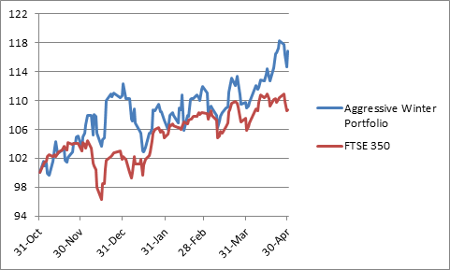

Our Aggressive Winter Portfolio was almost always ahead of the FTSE 350. At the end of 2014 it was up 12% compared with a modest 2% gain for the benchmark index.

Part of that early success was down to online gaming group . It admitted in November that bid talks were underway, and a month later the shares were up almost 32% on the portfolio entry price. By February, however, the market had decided an offer was unlikely and the shares never recovered. That made the portfolio's stunning gains all the more remarkable.

Top marks go to housebuilder . The sector has, historically, traded well in the run-up to the spring house-buying season, and this year was no different. Taylor finished the portfolio period up 40% and at a six-year high, with fundamentals for the industry expected to remain strong for some time.

And lastly, internet gambling technology firm clocked up a 16% gain over the six months. In that time it built up quite a fan club in the City, and despite some concerns about its Malaysia business mid-period, full-year results were good and this year is tipped to be even better. The shares have never been higher.

Dividend payments on a £1,000 investment in each stock within the aggressive portfolio were £49.20 over the six months.

Aggressive Winter Portfolio, Performance 1 November 2014-30 April 2015

Summer Portfolios

Our two Summer Portfolios have got off to a flying start, despite uncertainty around the general election. While the consistent portfolio largely tracked the FTSE 350 and is currently up 1%, the aggressive portfolio is already up a spectacular 7% in just one week.

Don't expect that every week, but if statistics for the past 10 years are any indication of future performance, there could be more to come over the next six months.

*Do remember to factor in commission costs when purchasing model portfolios. Small sums invested will be disproportionately impacted by charges.

Purchase The UK Stock Market Almanac 2015 for the special prices of £15 + P&P (hardback) or £10 (ebook). Order at Harriman House using promotional codeII_ALMANAC_Hb (hardback) or II_ALMANAC_Eb (ebook).

Find out more at stockmarket.co.uk.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.