Housebuilders extend post-election rally

13th May 2015 14:21

by Harriet Mann from interactive investor

Share on

The historical trend for housebuilders to outperform in the first quarter of the year is well-known in the City. This year was no exception. However, a surprise Tory win in last week's general election has extended the winning run deep into Q2, and share prices are up a staggering 10% since David Cameron sealed another five years at Number 10.

Fears over Labour's Mansion Tax and rent control proposals had put pressure on the housing market in the run up to polling day. Investor's Chronicle columnist Simon Thompson, who developed the seasonal sector strategy, closed his long position back in early March, banking a 19% profit on the trade. He cited unnecessary risk during such an uncertain election.

Both and have done well since May 7 - up 15% and 11% respectively - and latest updates have been well-received.

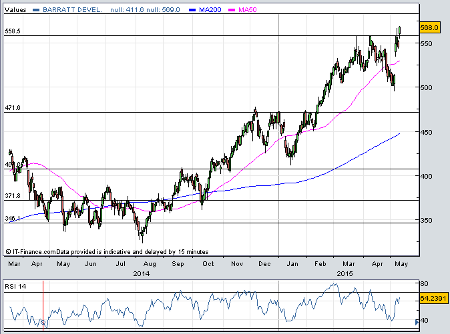

Barratt Development

Thanks to increasing demand for new homes across the UK and benefits of the Help to Buy scheme, Barratt now reckons it can complete 16,100 homes this year, ahead of previous expectations. Sales are already up 18% on the year at £2.6 billion, a record for the group. Its £4.5 billion of investment in approved land is paying off and 64 new developments were launched across the UK in the period.

Chief executive Mark Clare said: "We are on track to deliver a further significant step up in our financial performance in FY15, making good progress towards achieving our FY17 targets of a gross margin of at least 20% and return on capital employed of at least 25%."

But analysts from JP Morgan warn that as the upgraded sales volume will largely come from low-margin sites, the impact on full-year operating profit will be limited. Still, a small upgrade to joint venture profit expectations should push consensus up by 2%, says the broker.

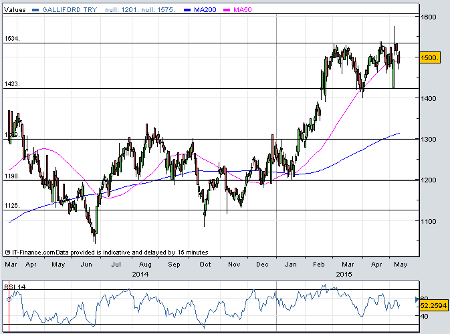

Galliford Try

With an order book of £3.3 billion, 83% of next year's revenue is secured. The business has £982 million of sales reserved and £778 million will be recognised in this year's results. This revenue comes from both Linden Homes, which has improved its selling rate to 0.68 per week, and Galliford Try Partnerships, which has a contract order book of £650 million. The group already has a record land bank of 15,000 plots and is looking for further growth opportunities.

Executive chairman Greg Fitzgerald is "pleased" demand is strong in all parts of the group and expects full-year results to come in line with analysts' consensus in July.

"The board has a clear strategy to 2018 of disciplined and sustainable growth across all of Galliford Try's businesses. With the recent appointment of a new CEO joining a strong executive team, and with the board further strengthened by a number of non-executive appointments, the board is confident that this strategy will continue to be executed successfully."

Concerns

While industry fundamentals remain sound, there are concerns investor should be aware of.

Shore Capital is worried about increasing project costs and their deliverability, a concern supported by figures showing nearly half of all firms found it difficult to recruit labour in the first quarter. The National Specialist Contractors Council survey claims that 28% of firms were unable to bid, which they blame on supply constraints.

"Although the NSCC does not split its results geographically, we are sure London is the epicentre of the issue," says Westhouse Securities analyst Alistair Stewart. "We believe this is an issue that will grow in magnitude thoughout the rest of this year at least and should impact contractors and London-focussed housebuilders."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.