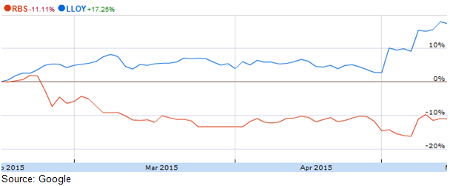

Royal Bank of Scotland vs Lloyds Banking

14th May 2015 10:04

Banks are back in favour. An outright Tory win at the polls last week was a shot in the arm for the sector, and share prices have rocketed since. A more supportive market for bank stocks should be felt across the board, but there are some key differences between taxpayer-owned and which puts one ahead of the other.

RBS has materially underperformed the sector so far this year - it's down 16% FX adjusted - and has underperformed Lloyds by almost 30%. But RBS at least remains on the "right strategic track", thinks JP Morgan. "Over the next three years we see RBS shrinking to a high PE UK retail and commercial bank that could return substantial capital (>£10bn) to shareholders."

"However, in our view the attractions of the shares lie well beyond our 12-month time horizon, so we remain Neutral at 0.9x P/TNAV [price/tangible net asset value] and 12x 2017E PE."

A rumoured government stake sale would increase liquidity for long-term shareholders, too - a current free float of just 21% is a potential deterrent to some investors. Press reports suggest the new Conservative administration will sell down its 80% stake at a loss - currently £13.5 billion - later this year. The Treasury has made a tidy profit on its holding in fellow bailed-out lender Lloyds.

(click to enlarge)

"We estimate that RBS can return c£10bn in 2018, which is 25% of market cap," says JPM. "The Lloyds trading plan strategy has allowed a rising share price alongside a lower government holding (sub 20%) and we believe that a similar (albeit more gradual) outcome may be possible with RBS."

Of course, RBS is committed to a leaner, less volatile business based around its core Personal & Business Banking (PBB) and Commercial & Private Banking (CPB) activities. The so-called "go-forward" bank is thought by JPM to be worth 291-339p per share. That compares with a group valuation range of 291-410p, which depends on assumptions of return on tangible equity (RoTE), value of exit assets, and litigation costs which are uncertain.

"We estimate go-forward revenues should start growing in FY16E and expect go-forward earnings to rise from £3.1bn FY15E to £3.8bn FY19E, leading to 14% RoE," says the broker, which sticks with its price target of 370p.

"Within the UK, Lloyds remains our top pick, with the dividend (6.1% yield) and cash return story more imminent. From a valuation perspective, we see better attractions at Barclays (0.8x P/TNAV and 8.1x 17 PE), where core bank profitability continues to improve, with Non-Core rundown absorbing litigation risk."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks