A low-risk, high-dividend play

15th May 2015 15:43

by Lee Wild from interactive investor

Share on

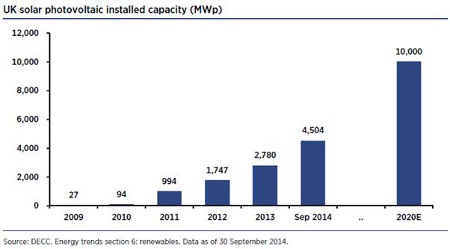

buys and manages solar power plants across the UK. It's already bought 17 of them, but the government has pledged to generate 15% of all the country's energy needs from renewables by 2020, so that will rise quickly. The shares are on track to yield 5% in 2015, too, just a year after the company listed in London, then 6% in 2016. Increasing the payout in line with RPI over the long term makes the shares attractive for investors seeking yield and inflation protection.

And NextEnergy is certainly very good at what it does. Michael Bonte-Friedheim, a 20-year veteran of the energy industry, set up NextEnergy Capital, the fund's manager, in 2007. Before that he'd run oil companies Valiant Petroleum and Mediterranean Oil and Gas, and headed up the European energy & power team at Goldman Sachs before leaving in 2006.

"The UK solar market has come of age as an investment proposition, offering long-term stable returns with RPI linkage while helping the UK achieve its renewable energy targets," says Bonte-Friedheim.

"We can buy and manage assets better than anyone else," he told Interactive Investor recently. That's because it has 35 highly-trained experts who can quickly identify the best assets and, more importantly, can spot any problems with the modules or wiring. We're told it does happen.

(click to enlarge)

And NextEnergy prides itself on this expertise and low-risk approach. The company will never build the plant and often will come in late on a project. When it does get in early, the company will monitor construction like a hawk. It only buys solar projects, and sticks to the UK which has the most stable regulatory framework.

Following a pair of acquisitions last month - Glebe Farm in Bedfordshire and Hawkers Farm in Somerset - NextEnergy now has 217 megawatt peak (MWp) of solar assets. These two cost almost £55 million and mean the fund, which raised £85 million when it floated, has now spent the £246.6 million raised since. The £61 million collected from a share placing in February went in just seven weeks.

The fund has an undrawn revolving credit facility of up to £31.5 million, but a fundraising seems inevitable and would not surprise the market. Bonte-Friedheim tells us he wants to grow the fund from £250 million to between £750 million and £1 billion over the next three-five years.

(click to enlarge)

There are still opportunities to snap up large scale assets which still qualify for Renewable Obligation Certificates (ROCs) - projects not accredited before 31 March 2015 now come under the new Contracts for Difference (CfD) regime. There are smaller scale ROC projects, too.

But assets bought by Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EISs) during a first wave of solar investment are now coming up for sale - these funds have a finite life. And Bonte-Friedheim is on the lookout for the best assets, and where output can be improved. He's also built up a portfolio of 3,000 roof-top solar systems on commercial properties in the UK. Expect more.

Of course, the fund is set up to generate income for shareholders, and last month it confirmed investors were on track to receive 5.25p a share for the year ended 31 March 2015 - a half-year divi of 2.625p has ready been paid. The idea is to ramp that up to 6.25p then adjust on an annual basis in line with RPI.

That's exactly why big funds and wealth managers have got involved. Currently Prudential has a 25% stake, Artemis Investment Management 19% and Investec Wealth & Investment 13%.

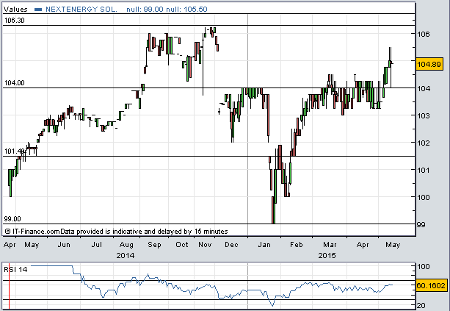

Analysts at Macquarie have set a 108p price target which implies capital appreciation of almost 4% and a total shareholder return (TSR) of 9.8%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.