Five myths of investing

1st June 2015 10:23

I am going to take a little detour this weekend from the usual macroeconomic/market analysis to dispel a few "Wall Street" myths about long-term investing.

1) The market has generated 10% annual returns

One of the biggest myths perpetrated by Wall Street on investors is showing individuals the following chart and telling them over the “long-term” the stockmarket has generated a 10% annualised total return.

The statement is not entirely false. Since 1900, stockmarket appreciation plus dividends have provided investors with an AVERAGE return of 10% per year. Historically, 4%, or 40% of the total return, came from dividends alone. The other 60% came from capital appreciation that averaged 6% and equated to the long-term growth rate of the economy.

However, there are several fallacies with the notion that if you invest in the markets long-term you will continue to accrue a 10% annualised rate of return.

1) The market does not return 10% every year. There are many years where market returns have been sharply higher and significantly lower.

2) The analysis does not include the real world effects of inflation, taxes, fees and other expenses that subtract from total returns over the long-term.

3) You don't have 144 years to invest and save.

(click to enlarge)

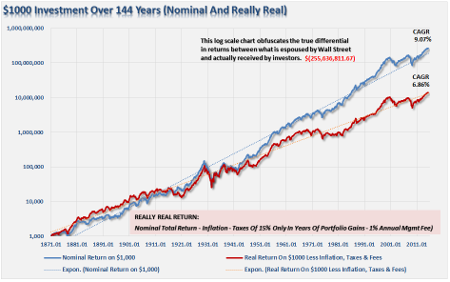

The chart below shows what happens to a $1,000 investment from 1871 to present including the effects of inflation, taxes, and fees. (Assumptions: I have used a 15% tax rate on years the portfolio advanced in value, CPI as the benchmark for inflation and a 1% annual expense ratio. In reality, all of these assumptions are quite likely on the low side.)

(click to enlarge)

As you can see, there is a dramatic difference in outcomes over the long-term.

From 1871 to present the total nominal return was 9.07% versus just 6.86% on a "real" basis. While the percentages may not seem like much, over such a long period the ending value of the original $1,000 investment was lower by an astounding $260 million dollars.

Importantly, as stated previously, and as I will discuss more in a moment, the return that investors receive from the financial markets is more dependent on the "WHEN" you begin investing.

2) I can beat/outperform the stockmarket

No, you can't. Stop trying. I discussed this idea in much more detail in "Why you can't beat the index." However, here is the important point.

The issues of stock buybacks, the "substitution effect", taxes, expenses and fees all lead to the underperformance of the index. In a recent article, a study found that only 1 in 4 mutual fund managers outperforms the market index over long periods of time. Of those that outperformed the average outperformance was .12% before fees and expenses. However, the fees and expenses were larger than the level of outperformance. This, of course, does not also include the tax impact on gains and income.

The problem with chasing performance, of course, is that once you fall behind you take on MORE risk to try and make up the difference. This leads, ultimately, to bigger mistakes that cost investors dearly.

This could not be more to the point than anything that we have discussed today. Comparison of your performance to an index is the most useless, and potentially dangerous, the thing that you can do as an investor.

Comparison is the cause of more unhappiness in the world than anything else. Perhaps it is inevitable that human beings as social animals have an urge to compare themselves with one another. Maybe it is just because we are all terminally insecure in some cosmic sense. Social comparison comes in many different guises. "Keeping up with the Joneses," is one well-known way.

If your boss gave you a Mercedes as a yearly bonus, you would be thrilled - right up until you found out everyone else in the office got two cars. Then you are ticked. However, really, are you deprived for getting a Mercedes? Isn't that enough?

Comparison-created unhappiness and insecurity is pervasive. The basic principle seems to be that whatever we have is enough, until we see someone else who has more. Whatever the reason, comparison in financial markets can lead to remarkably bad decisions.

Comparison in the financial arena is the main reason clients have trouble patiently sitting on their hands, letting whatever process they are comfortable with work for them. They get waylaid by some comparison along the way and lose their focus. If you tell a client that they made 12% on their account, they are very pleased. If you subsequently inform them that "everyone else" made 14%, you have made them upset. The whole financial services industry, as it is constructed now, is predicated on making people upset so they will move their money around in a frenzy. Money in motion creates fees and commissions. The creation of more and more benchmarks and style boxes is nothing more than the creation of more things to COMPARE to, allowing clients to stay in a perpetual state of outrage.

The major learning point is that chasing a "benchmark index" is a mistake because of the following reasons:

• The index contains no cash

• It has no life expectancy requirements - but you do.

• It does not have to compensate for distributions to meet living needs - but you do.

• It requires you to take on excess risk (potential for loss) to obtain equivalent performance - this is fine on the way up, but not on the way down.

• It has no taxes, costs or other expenses associated with it - but you do.

• It can substitute at no penalty - but you don't.

• It benefits from share buybacks - but you don't.

To win the long-term investing game, your portfolio should be built around the things that matter most to you.

• Capital preservation

• A rate of return sufficient to keep pace with the rate of inflation.

• Expectations based on realistic objectives. (The market does not compound at 8%, 6% or 4%)

• Higher rates of return require an exponential increase in the underlying risk profile. This tends to not work out well.

• You can replace lost capital - but you can't replace lost time. Time is a precious commodity that you cannot afford to waste.

• Portfolios are time-frame specific. If you have a 5-years to retirement but build a portfolio with a 20-year time horizon (taking on more risk) the results will likely be disastrous.

The index is a mythical creature, like the Unicorn, and chasing it takes your focus off of what is most important - your money and your specific goals. Investing is not a competition, and there are horrid consequences for treating it as such.

However, we are getting ever closer to a breakdown in the market which will likely be larger and more vicious than you can currently imagine. When that will occur - I honestly do NOT have a clue. The Fed's interventions can keep the market pushing higher longer than we can rationally expect. What I do know, and I know this with absolute clarity, is that a correction will come. When the correction occurs, we need to be ready to act. Such a correction, as with all corrections and crashes, will be a buying opportunity - the only question will be from where?

3) Your financial plan says you will be just fine

One the biggest mistakes that investors make are in the planning assumptions for their retirement. As I discussed in much detail this past week:

There is a massive difference between compounded returns and real returns as shown. The assumption is that an investment is made in 1965 at the age of 20. In 2000, the individual is now 55 and just 10 years from retirement. The S&P index is actual through 2014 and projected through age 100 using historical volatility and market cycles as a precedent for future returns.

(click to enlarge)

While the historical AVERAGE return is 7% for both series, the shortfall between "compounded" returns and "actual" returns is significant. That deficit is compounded further when you begin to add in the impact of fees, taxes and inflation over the given time frame.

The single biggest mistake made in financial planning is NOT to include variable rates of return in your planning process.

Furthermore, choosing rates of return for planning purposes that are outside historical norms is a critical mistake. Stocks tend to grow roughly at the rate of GDP plus dividends. Into today's world GDP is expected grow at approximately 2% in the future with dividends around 2% currently. The difference between 8% returns and 4% is quite substantial. Also, to achieve 8% in a 4% return environment, you must increase your return over the market by 100%. The level of "risk" that must be taken on to outperform the markets by such a degree is enormous. While markets can have years of significant outperformance, it only takes one devastating year of losses to wipe out years of accumulation.

Plan for realistic returns in the future as well as adjust and account for market swings that will impact the ending value of your money.

4) If you're not in, you're missing out

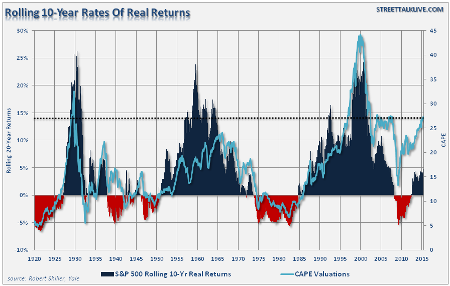

It is often stated that you should be invested in the markets because there has NEVER been a 10-year period that has produced negative returns for investors. That is simply not true.

(click to enlarge)

There are two important points to take away from the data. First, is that there are several periods throughout history where market returns were not only low, but negative. Secondly, the periods of low returns follow periods of excessive market valuations.

In other words, it is vital to understand the "WHEN" you are investing so that return expectations are aligned with reality.

The chart below compares Shiller's 10-year CAPE to 10-year actual forward returns from the S&P 500.

(click to enlarge)

From current levels history suggest that returns to investors over the next 10-years will likely be lower than higher. We can also prove this mathematically as well as shown.

Capital gains from markets are primarily a function of market capitalisation, nominal economic growth plus the dividend yield. Using John Hussman's formula we can mathematically calculate returns over the next 10-year period as follows:

(1+nominal GDP growth)*(normal market cap to GDP ratio/actual market cap to GDP ratio)^(1/10)-1

Therefore, IF we assume that GDP could maintain 4% annualised growth in the future, with no recessions, AND IF current market cap/GDP stays flat at 1.25, AND IF the current dividend yield of roughly 2% remains, we get forward returns of:

(1.04)*(.8/1.25)^(1/10)-1+.02 = 1.5%

But there're a "whole lotta ifs" in that assumption. More importantly, if we assume that inflation remains stagnant at 2%, as the Fed hopes, this would mean a real rate of return of -0.5%. This is certainly not what investors are hoping for.

5) You can't time the market - just buy and hold

There are no great investors of our time that "buy and hold" investments. Even the great Warren Buffett occasionally sells investments. Real investors buy when they see value and sell when value no longer exists.

While there are many sophisticated methods of handling risk within a portfolio, even using a basic method of price analysis, such as a moving average crossover, can be a valuable tool over the long term holding periods. Will such a method ALWAYS be right? Absolutely not. However, will such a method keep you from losing large amounts of capital? Absolutely.

The chart below shows a simple moving average crossover study. The actual moving averages used are not relevant, but what is clear is that using a basic form of price movement analysis can provide a useful identification of periods when portfolio risk should be REDUCED. Importantly, I did not say risk should be eliminated; just reduced.

(click to enlarge)

Again, I am not implying, suggesting or stating that such signals mean going 100% to cash. What I am suggesting is that when "sell signals" are given that is the time when individuals should perform some basic portfolio risk management such as:

• Trim back winning positions to original portfolio weights: Investment rule: let winners run

• Sell positions that simply are not working (if the position was not working in a rising market, it likely won't in a declining market.) Investment rule: cut losers short

• Hold the cash raised from these activities until the next buying opportunity occurs. Investment rule: buy low

The reason that portfolio risk management is so crucial is that it is not "missing the 10-best days" that is important; it is "missing the 10-worst days." The chart below shows the comparison of $100,000 invested in the S&P 500 Index (log scale base 2) and the return when adjusted for missing the 10 best and worst days.

(click to enlarge)

Clearly, avoiding major drawdowns in the market is key to long-term investment success. If I am not spending the bulk of my time making up previous losses in my portfolio, I spend more time compounding my invested dollars towards my long term goals.

Conclusion

There are many half-truths perpetrated on individuals by Wall Street to sell product, gain assets, etc. However, if individuals took a moment to think about it, the illogic of many of these arguments are readily apparent.

The simple fact is that you cannot solely INVEST your way to your retirement goal. As the last decade should have taught you by now, the stockmarket is not a "get wealthy for retirement" scheme. You cannot continue to undersave for your retirement hoping the stockmarket will make up the difference. This is the same trap that pension funds all across this country have fallen into and are now for which they are paying the price.

Chasing an arbitrary index that is 100% invested in the equity market requires you to take on far more risk that you realise. Two massive bear markets over the last decade have left many individuals further away from retirement than they ever imagined. Furthermore, all investors lost something far more valuable than money - the TIME that was needed to prepare adequately for retirement.

Investing for retirement, no matter what age you are, should be done conservatively and cautiously with the goal of outpacing inflation over time. This doesn't mean that you should never invest in the stockmarket, it just means that your portfolio should be constructed to deliver a rate of return sufficient to meet your long-term goals with as little risk as possible.

1. The only way to ensure you will be adequately prepared for retirement is to "save more and spend less." It ain't sexy, but it will work.

2. You Will Be WRONG. The markets cycle, just like the economy, and what goes up will eventually come down. More importantly, the further the markets rise, the bigger the correction will be. RISK does NOT equal return. RISK = How much you will lose when you are wrong, and you will be wrong more often than you think.

3. Don't worry about paying off your house. A paid off house is great, but if you are going into retirement house rich and cash poor you will be in trouble. You don't pay off your house UNTIL your retirement savings are fully in place and secure.

4. In regards to retirement savings - have a large CASH cushion going into retirement. You do not want to be forced to draw OUT of a pool of investments during years where the market is declining. This compounds the losses in the portfolio and destroys principal which cannot be replaced.

5. Plan for the worst. You should want a happy and secure retirement - so plan for the worst. If you are banking solely on Social Security and a pension plan, what would happen if the pension was cut? Corporate bankruptcies happen all the time and to companies that most never expected. By planning for the worst, any other outcome means you are in great shape.

Most likely whatever retirement planning you have done, is wrong. Change your assumptions, ask questions and plan for the worst. There is no one more concerned about YOUR money than you and if you don't take an active interest in your money - why should anyone else?

Lance Roberts is a General Partner of STA Wealth Management. He is also the host of "Street Talk with Lance Roberts", Chief Editor of "The X-Factor" Investment Newsletter and author of "The Daily Exchange" blog Follow Lance on Facebook, Twitter and Linked-In.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks