Share of the week: Cairn showered with upgrades

5th June 2015 14:02

by Lee Wild from interactive investor

Share on

With the down 2.5% and the FTSE 350 faring only marginally better, there really has been little to choose from this week. Of those companies that have done well, , up 13%, has already appeared in this feature. Next best performer is - up 9% since Friday last week - and, while we've covered it recently elsewhere, too, there's more to tell about this interesting oil play.

Last month, Cairn held a Capital Markets Day (CMD) presentation on its operations in Senegal for analysts and institutional shareholders. Days later, FAR Ltd - Australian oil and gas explorer and Cairn's 15% partner in three blocks offshore Senegal - held a bullish AGM, which got investors excited.

This combination highlighted the "potential for low risk appraisal drilling and longer-term resource/reserves growth offshore Senegal", said broker RBC Capital on Monday. "Although the Indian tax dispute remains we anticipate any material developments to take place after the outcome of the drilling campaign. As a result we are taking advantage of recent share price weakness to reinstate our Outperform rating and increase our Price Target to 250p/share [from 220p]."

At the CMD, Cairn outlined appraisal drilling plans on the 330 million barrels (mmbbls) SNE oil discovery offshore Senegal that unrisked could add a further 70p per share.

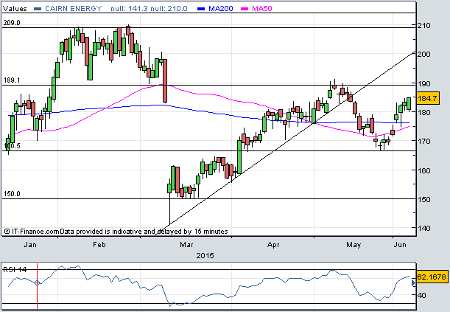

(click to enlarge)

As part of a discussion on spotting oil sector M&A activity broker Jefferies also shone the spotlight on Cairn.

"We roll forward Cairn due to its early position in the cycle of converting the SNE-1 discovery into 2P reserves," said analyst Mark Wilson. "Assuming Cairn trades at our price target of 222p/share [up from 175p] and converts its current WI [working interest] resources of 40% (i.e., no farm down) the stock would trade at US$11.0/boe for EV/2P reserves."

However, using a typical M&A metric range of $15-17/boe and assuming 2P reserves roll forward as the above proforma, Wilson sees Cairn trading at $15/boe if the company were to carry net debt of $500 million. Limit cash burn to its existing cash balance of $869 million, bring UK North Sea production on stream in 2017 and keep an ungeared balance sheet, and that could hit $17/boe at an implied target price of 315p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.