13 shares worth the premium

12th June 2015 16:02

No one wants to overpay for something whether it's a car, a house, or just the weekly shop. We're all on the lookout for value. And it's the same with shares. Quite rightly, investors prefer to back good-quality companies at a reasonable price, weeding out stocks which appear overvalued. But the risk here is that fantastic companies never make it to the 'buy' list just because they look pricey. However, our research reveals that adopting this approach can be an expensive mistake.

How many of us have run the rule over a great company then got to the valuation and winced? Odds are that most of us have. I can recount dozens of occasions over the years when I've shaken my head and thought "you must be kidding?". Of course, it's too simplistic to value a company solely on the price/earnings (P/E) ratio, but it's a pretty good yardstick, and once it gets into the high teens/early 20s, there had better be a good reason.

Sometimes I've been proved right and called the top of the market in a few stocks - and in 2013 spring to mind. But there are just as many that have got away; where a P/E in the mid-to-high 20s has proven to be the norm - stand up property website and upmarket fashion retailer . It's meant missing out on potentially huge profits as rapid earnings growth drives the shares skyward.

| Name | TIDM | Price | Yield | Dividend cover | Forward P/E ratio | P/E 5-year avg | P/E 10-year avg | 2-year share price (%) | 5-year share price (%) |

| Arm Holdings | ARM | 1,115p | 0..6 | 2.6 | 37.5 | 73.1 | 58.3 | 26 | 319 |

| Ted Baker | TED | 2,814p | 1.4 | 2.1 | 29.4 | 23.9 | 19.4 | 98 | 465 |

| Rightmove | RMV | 3,231p | 1.1 | 2.8 | 29.3 | 29.4 | 61 | 371 | |

| Halma | HLMA | 750p | 1.5 | 2.5 | 24.7 | 23.6 | 18.2 | 42 | 197 |

| Croda International | CRDA | 2,845p | 2.3 | 1.9 | 21.7 | 15.9 | 17.8 | 14 | 178 |

| Victrex | VCT | 1,992p | 2.2 | 2.1 | 20.5 | 18.5 | 19.5 | 19 | 85 |

| Grafton Group | GFTU | 834p | 1.3 | 3.1 | 20.1 | 17.8 | 17.0 | 79 | 210 |

| Renishaw | RSW | 2,423p | 1.7 | 1.9 | 15.8 | 10.5 | 21.7 | 38 | 245 |

| Ultra Electronics | ULE | 1,865p | 2.4 | 1.1 | 15.4 | 14.1 | 68.3 | 13 | 15 |

| Rotork | ROR | 249p | 2.0 | 2.4 | 21.0 | 23.1 | 21.2 | -7 | 84 |

| Robert Walters | RWA | 416p | 1.4 | 2.4 | 24.5 | 15.7 | 47.5 | 90 | 101 |

| Compass Group | CPG | 1,115p | 2.4 | 1.8 | 20.2 | 24.5 | 18.8 | 25 | 86 |

| Oxford Instruments | OXIG | 985p | 1.2 | 3.7 | 22.8 | 12.8 | 23.8 | -36 | 286 |

| Source: Sharepad.co.uk | |||||||||

, the chemicals company which makes the "super material" PEEK, has never been cheap, either. Nor has high-tech defence contractor , or computer chip designer . But deciding not to buy any of these companies would have meant missing out on substantial share price gains over the past five, or even two years (see table).

For these names there are often very clear reasons why savvy investors are willing to pay a premium for the shares. And it's absolutely worth reminding ourselves of legendary growth investor Philip A. Fisher's wise words. In his 1958 book 'Common Stocks and Uncommon Profits', the man who provided inspiration for Warren Buffett said:

If the company is deliberately and consistently developing new sources of earning power, and if the industry is one promising to afford equal growth spurts in the future, the price/earnings ratio five or 10 years in the future is rather sure to be as much above that of the average stock as it is today.

Stocks of this type will frequently be found to be discounting the future much less than many investors believe. This is why some of the stocks that at first glance appear highest priced may, upon analysis, be the biggest bargains.

Clearly, our 13 companies are able to meet enough of the criteria which drive hefty valuation multiples, be it consistency of top-line growth, higher-than-average margins, strong cash generation or rapid growth in earnings. Not all of them are currently worth buying, but it's certainly nothing to do with valuation. These companies are never likely to appear cheap on traditional valuation metrics, but then sometimes you just have to bite the bullet and pay up. Quality does not come cheap, and neither do some shares.

Here are some of the 13 companies featured in the table above that are rarely cheap, but which are worthy of consideration in a long-term investor's portfolio.

Rotork

Rotork is a company I've followed for a number of years, and while the business is clearly first-class, it's always traded on a forward earnings multiple of at least 20 times. It has supplied pumps and valves to oil companies, power stations and water plants for over half a century, and is able to deliver growth throughout economic cycles.

It was one of only two UK engineers to report positive earnings progression through the last recession, driven by both top-line organic growth and margin improvement. But that quality comes at a price. And in 2013, it was a price I believed was too high given forecasts for modest mid-single digit earnings growth.

I wasn't alone. The shares (then 279p adjusted for the recent 10-for-1 subdivision) have moved sideways for the past two years. There's not much of a dividend, either, so holding the shares tied up money that could have been working harder elsewhere.

And, while selling emergency shutdown valve actuators to the oil & gas industry has been good business in the past, the well-documented slump in industry capex will hurt profits, although by quite how much is still unclear. But even now Rotork shares trade on over 20 times earnings forecasts for 2015, despite Numis Securities' estimates for a 6% drop in EPS. That, the broker says, "is undoubtedly expensive", but argues that this is no reason to give up on the company.

"As end markets start to recover so will investor confidence with expectation that earnings growth will turn positive and accelerate," writes respected analyst David Larkam. "A return to a P/E in the 22-24x range and EV/Sales of 4x suggests 290p price target at this juncture."

ARM Holdings

Believe it or not, chip designer ARM Holdings was cheap once. It was spun out of BBC computer maker Acorn in 1990 and floated eight years later. But during the dotcom boom of the late-90s, ARM shares rocketed, and in 1999 it entered the FTSE 100. But the tech sector imploded spectacularly, and it wasn't until after the last recession in 2009 that the share price recovery finally began in earnest. Now, you have to pay a hefty premium.

ARM, however, is a classic "it's too expensive" stock. Yes, fast-growing tech companies typically trade on sky-high multiples, but ARM has deterred some of the hardiest growth investors in its time. It shouldn’t have. The company controls a huge share of the market and is one of Apple's key suppliers.

In 2009, ARM made a pre-tax profit of £47.3 million and you could have bought the shares for less than 90p. Last year, it made over £316 million and the shares are worth £11! This year, Numis thinks operating profit will jump by 30% to £518 million, and predicts that EPS will grow by 26% each year until 2017. First-quarter results already beat forecasts, and royalties are now expected to exceed estimates in 2015.

"The stock is still trading at the lower end of its 35-55x historic P/E range and there is a strong fundamental argument for further value creation as ARM technology is increasingly deployed to enable IoT [Internet of Things]," says Nick James at Numis. He thinks the shares are worth 1,350p.

Rightmove

No one has ever called Rightmove shares a bargain. Trawling back through the records, the property website's shares have traded on forward P/E multiples in the high 20s/low 30s since way before the credit crunch. But it's been consistent, too, even through the recession. And that's where it is now.

I remember numerous conversations with colleagues past and present, discussing how it was possible to justify buying Rightmove at 30 times earnings. Well, the justification is EPS growth consistently above 20% and tipped to remain in double digits at least for this year and next.

And, despite the flotation of providing investors with an alternative online property play for the first time, Rightmove is more than holding its own. Investec Securities said after the full-year results that the valuation (with the shares at 2,647p) "looks high" given the possible slowdown in the housing market. But Rightmove was still breaking records at the beginning of the year, and next month's interim results should reveal further solid performance.

Robert Walters

Recruitment is a highly cycle industry, and shares in have not always traded on eye-watering multiples. At the nadir of 2008 they were on low single digits! But when the times are good, the valuation rockets - high 20s/low 30s - which is where we've been for the last few years.

But with the shares now at a record high, should investors be paying 25 times earnings for the recruiter? Well, April's first-quarter update was certainly bullish - gross profit, or net fee income, jumped by 12% and the company said full-year profit would be better than expected. And the momentum has largely carried through the last few months.

Clearly, these are the good times. But a recent capital markets day presentation to analysts and large investors showed how productivity gains should deliver increasing conversion ratios, and how the existing global business is sufficient to drive significant net fee income growth.

"On a simple P/E basis the shares are looking fully valued (23.0x 12 month forward)," said Panmure Gordon analyst Adrian Kearsey. "However, given the net fee income growth and the now well entrenched earnings momentum the shares are on an attractive PEG of 0.7." The shares are worth 450p, he says.

Ted Baker

Ted Baker sells expensive clothes to aspirational youngsters through a chain of stores both here and overseas. It's high quality stuff, much like the shares. Sales rose 24% in the 18 weeks to 6 June, and Baker has opened stores in Hong Kong, and concessions in Europe, North America, China and Japan.

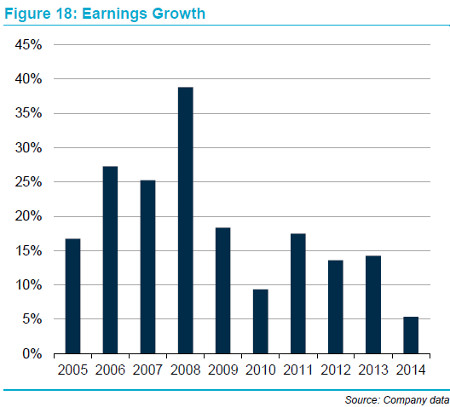

Of course, you have to pay for quality, and a forward P/E ratio of around 29 might make even the most fashionable investor head elsewhere. But Baker is no fly-by-night success story. It has a cracking track record, delivering EPS compound annual growth rate (CAGR) of 12% in the decade to 2014 and 19% over the past five years. Peel Hunt reckons international sales now point to a three-year CAGR of 17.3% and values the shares at 3,100p.

Halma

A series of acquisitions has built into a mini conglomerate. It makes valves and pumps for blood analysis equipment, safety products to North Sea oil & gas explorers, and sensors for automatic doors and water quality detectors. That diversification has proved invaluable, and every year seems to be a record year at Halma.

Indeed, the company reported record revenue (£726 million) and underlying profit (£153.6 million) for the twelfth consecutive year in the 12 months to March. The trailing five-year and 10-year EPS CAGR is now 13% and Numis Securities thinks that, combined with 5% organic growth, earnings should grow at about that level until 2020.

It's that kind of reliability which keeps investors paying high multiples for the shares - a forward PE of 23.5 is near an all-time high, a premium of 52% to JP Morgan's UK Capital Goods peer group.

Victrex

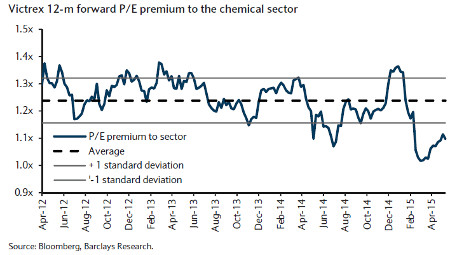

Barclays recently issued a super-bullish note which suggested Victrex shares could be "worth many multiples of what they are today". The company - spun out of ICI in 1993 - supplies car makers, plane companies and the medical industry with a lightweight, super-strength, heat-resistant plastic called PEEK. Each Boeing 787 Dreamliner uses about a tonne of it. But investors have always been willing to pay a premium for the shares, and nothing has changed.

However, that premium to the sector has narrowed recently from its three-year average of 24% to just 10%, presenting "a rare opportunity to buy into a long-term growth story for a (relatively) modest price," writes Barclays. It thinks the discount could return to the mid-term average over the next 12 months and shift the share price up to 2,400p. Last year's big electronics order and GBP/USD depreciation over the next year should easily offset weak demand from the oil & gas sector.

Ultra Electronics

Paying $265 million in cash for the electronic products division (EPD) of Kratos Defense & Security Solutions is a smart move by Ultra Electronics. For that money it gets a major presence in the electronic warfare market, supplying the Trident missile, F-16 and Eurofighter programmes. It will boost earnings, too.

While Ultra's earnings multiple is nowhere near most of the highly-rated firms featured here, the defence contractor has always traded at a premium to the sector. Espirito Santo analyst Ed Stacey thinks that premium should be about 130 basis points, in part to reflect a better trend of cash conversion than peers. A return to upper mid-single digit EPS growth compared with mid-single digits for rivals is helpful, too. In his last note, Stacey said valuing Ultra on a PE of 16.8 times versus 15.5 for the sector gave a price target of 2,100p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser

Editor's Picks