Innovation Group bags major deal

18th June 2015 16:59

by Harriet Mann from interactive investor

Share on

After heavy investment in its software business, securing a £46 million, ten-year contract with an unnamed insurer has given a fresh boost to recent rally. It's been touted by management as a "transformation" project, but more of these will be needed as a catalyst for the next leg up in the advance.

As a software solutions and outsourcer for the insurance, fleet, automotive and property industries, Innovation will give the latest addition to its books access to its complete eco-platform solution, including insurer policy, claims, analytics and self-service portal. As the software business grows, chief executive Andy Roberts is confident Innovation will keep winning more of these big deals.

Of the £46 million, £12 million will be recognised over the next year, with the rest recognised evenly across the remainder of the contract - around £3.8 million a year.

Roberts said: "While the timings of these deals will not always be certain, the medium-term picture for this business looks wholly positive, as Innovation Group stands to benefit from more insurance firms adopting third-party software."

Julian Yates, an analyst at Investec, believes the win backs up his forecasts of a swing from a first-half £4.6 million loss, to a second half profit of £4 million in the software business.

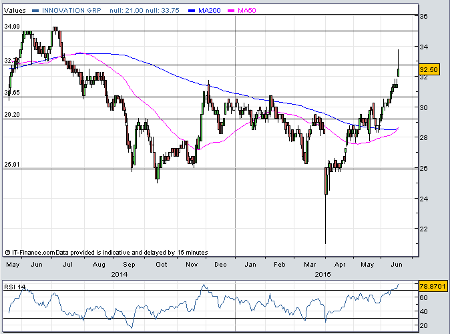

(click to enlarge)

"This is a significant industry win," says Yates. "We continue to see the separation of the Software business and BPS division as value enhancing and this win helps give the Software operations good critical mass which should enhance its medium term valuation. We retain our 36p SoTP-based target price and reiterate our Buy recommendation."

Innovation, which reported sales of £209.8 million last year, works with three-quarters of the top global property and casualty (P&C) insurance companies and three of the top five fleet and lease management companies. Last year, it split its business services and insurer business, appointing two separate chief executive to head the teams.

The shares rose by as much as 7% Wednesday to just under 34p, close to a 12-month high, putting them on a forward price/earnings (P/E) multiple of 16 times, way below the five-year average. Breaking above technical resistance at 35p will require more positive newsflow.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.