Four mid-cap infrastructure plays

19th June 2015 12:44

by Harriet Mann from interactive investor

Share on

Analysts at Barclays have been burning the midnight oil, compiling a 320-page bible on its 158 UK mid and small cap stocks which landed in our inbox this week. With decent construction figures and the mid-cap FTSE 250 index outperforming the blue-chip 100 by 13% over the last year, we've trawled Barclays' note looking for infrastructure gems.

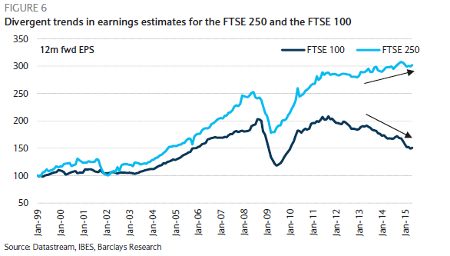

The FTSE 250 has beaten the FTSE 100 by over 4% since 1999 and over 7% in the last six years; only in the 2008 financial crisis and global growth scare of 2011 did the small and mid-cap market lose against the leading index. This positive correlation with the global economy suggests the FTSE 250 is influenced by global monetary events, say the analysts.

(click to enlarge)

Since 2012, earnings guidance for small and mid-cap companies have been slowly trending upwards while the FTSE 100 has suffered repeated downgrades. The market seems to have been blind to this trend, however, and the FTSE 250 has de-rated, with forward price/earnings (P/E) multiples near to 2011 and 2008 lows. As global economic growth gains traction and oil prices remain subdued, Barclays thinks the earnings gap will persist.

"We therefore believe the low relative valuation of the FTSE 250 relative to the FTSE 100 offers investors an opportunity to switch away from the FTSE 100, particularly from the Staples and Healthcare sectors towards the FTSE 250," it says.

Here's Barclays' take on four key mid-cap infrastructure and construction firms.

John Laing

, which floated in early 2015, invests in 40 projects across transport, renewable energy and social infrastructure sectors, all valued at £772 million. Barclays expects impressive net asset value (NAV) growth of 14% between 2015 and 2017, up from £650 million last December.

The investment group also has an attractive £1.3 billion pipeline in public private partnership and renewable energy, for which it has been able to generate returns of 23% and 25% respectively in the past. For those income hungry investors, John Laing wants to return £20 million, with special dividends paying 5-10% of realisations, implying a 4.5% yield at a 230p share price.

Management have found expansion opportunities in international public–private partnership (PPP) growth to protect itself from a slowdown in the UK. But Barclays' analysts warn that the group is highly sensitive to discount rates, so when interest rates inevitably go up, NAV will be hit.

We rate John Laing Overweight due to its attractive portfolio valuation and NAV growth. This should be delivered on the back of deployment of an existing outsized PPP pipeline as well as a falling discount rate applied to assets in construction as they are de-risked. The share is currently trading at a 2016E P/BV of 0.8x and P/E of 6.3x.

Halma

As a designer, manufacturer and seller of products that detect hazards and protect lives, operates in a broad selection of markets, including Infrastructure Safety and Environmental & Analysis. The 42 companies in the group produce products that detect water and gas leaks and build elevator door safety sensors. Despite its scope, each company tends to hold a strong position in the markets they operate in, which is handy given management's bid to double profit every five years. It boats 39 years of sales growth over the last 41.

Compared to peers, Halma is less open to the whims of the has pencilled in a pre-tax profit margin of between 18-22% this financial year with a post-tax return on total invested capital (ROTIC) of over 12%, down from 16.1% last year. After annual dividend increases of over 5% for the last 35 years, dividends are pretty certain. Management have the option for more M&A and growth in emerging markets.

We rate Halma very highly and it remains one of our core long term picks. Our only struggle with it at the present time remains valuation and it is for this reason only that we have an Equal Weight rating on a 12-month view. Halma has delivered an annualised 10-year TSR of c. 22%, compared to the sector average of c. 16% and FTSE 250 at c. 13%.

IMI

technology controls the movement of fluids, enabling important processes in the high-growth infrastructure, energy and transportation sectors. Barclays' analyst Richard Paige notes the change in management styles, from the former focus on product niches and pricing, to the new CEO Mark Selway's approach to capital investment in IT and improving manufacturing capacity. The analyst reckons there is around £1 billion of cash earmarked for future acquisition, noting it's a "clear" element of growth plans.

There are obvious cyclical risks with operating in the above markets, and further hardship is unlikely to be taken well. Although there is significant growth potential, Paige reckons strengthening the business will take priority, with only modest second half earnings growth in its 2015 financial year.

At 1,229p, the shares trade on 15.4 times forward earnings. The analysts reckon there is over 12% upside to its target price.

Galliford Try

The "hybrid" nature of business model combines its expanding housebuilding division with its construction operation. This allows it to reap many benefits, including the use of technical remediation skills in the housebuilding area.

The business is susceptible to the whims of the housing market, although it stands out from the crowd by offering a bespoke service. The group can take advantage of a recovering construction sector, and it has the opportunity to expand its presence in the private housebuilding market - where it operates under the Linden Homes brand - and the affordable housing sector.

Using a sum-of-the-parts valuation, Barclays analyst John Bell reckons the shares are worth 1,510p, lower than Thursday's close of 1,723p, which puts them on a price/earnings multiple of 16 times forward earnings. He believes the shares, which are close to all-time highs, have caught up with events and better value can be found elsewhere in the sector.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.