UK's most promising tobacco share

24th June 2015 13:46

by Harriet Mann from interactive investor

Share on

You won't find tobacco stocks in any ethical portfolio, but the tobacco sector has left the FTSE All-Share index choking on its fumes over the past five years. Both and are up by two-thirds compared with the market up just 37%, and their global nature brings crucial diversity as smoking trends change across the world. It has, however, created a foreign exchange headwind, which earnings in the first half of 2015. But with trends stabilising, and sales and profits improving this defensive industry looks poised to attack.

"We believe there is an underlying recovery in net revenue and operating profit growth for the tobacco industry taking place," say analysts at JP Morgan. "Yet we find individual companies face different trends due to their varied market exposures."

(click to enlarge)

(click to enlarge)

While many regions are turning their backs on the habit - the rate of men and women lighting up has more than halved since 1974 - the number of smokers across the globe is growing. There are currently 1.1 billion tobacco users globally, according to public health company Action on Smoking and Health, but they believe it could hit 1.6 billion in 20 years.

So, demand is set to grow and, despite global operations leaving them exposed to currency pressure on earnings, JP Morgan thinks the tobacco firms' improving cash flows should protect dividend growth.

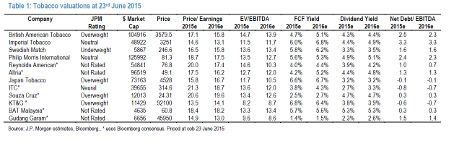

The analysts say: "We believe the tobacco sub-sector is attractive relative to our Food and HPC [Household and Personal Care] coverage with shares trading on a CY16 PE discount of 20% and 27%, respectively, the widest since 2005. Improving earnings growth in 2016 should help narrow the valuation gap to the broader sector."

With varied performance expected, we take a look at the two London-listed tobacco giants.

(click to enlarge)

British American Tobacco

Despite having the weakest start to 2015 - up less than 3% - JP Morgan is attracted to British American Tobacco's valuation and earnings potential. Mid-term EPS and cash flow growth is the most attractive in the sector, with forecast second-half EPS growth set to lead the pack at 6.5%, or 11.6% at constant currency.

Ahead of July's interim results, the broker expects a fall in first-half operating profit of nearly 10% due to declining volumes and price/mix, although profit should swing to 1% growth excluding any FX impact. Expect a 60 basis-point fall in operating margin to 38.6%.

Looking to full-year results, JP Morgan expects a 2.2% dip in volume to be offset by improvements to its price/mix, and for EPS of 209.3p, then 226.65p in 2016.

"We believe British American Tobacco will see a recovery in earnings in H2 as FX headwinds abate somewhat and, we hope, the company mitigates more of the transaction impact from FX faced in H1. We also believe the sequential improvement in pricing, which should be helped by the lapping of price competition in Australia, and the less difficult base for volumes in H114 should support improved growth."

With an 'overweight' recommendation and 4,100p target price, JP Morgan reckons the group's strong brands, good management, and resilient earnings and dividend growth. That will drive faster earnings growth than peers, but, at 3,580p, British American Tobacco trades on 15.8 times 2016 earnings, broadly comparable to peers and at a discount to European staples.

Imperial Tobacco Group

Imperial is set to regain strength in the second half, too. August's third-quarter update is expected to reveal a 5% fall in three-month net revenue, or 2.5% growth at constant currency. First-half volume pressure triggered by market disruptions in the Middle East should have softened.

Ignoring its £4.6 billion acquisition of American brands, volumes are expected to fall 2.5% in the second half with its first half price/mix of 4.3% improving to 6.7%. Like-for-like sales should be up 4.2%, with margin improving by 70 basis points, or 50bp at constant currency. Pre-tax profit for the year is set to reach £2.7 billion.

Nearly half of the group's profits come from Europe, with just over a fifth generated in the US. Unfortunately, the group isn't a price-setter in most of its markets, which will force earnings to grow at a more modest rate over the medium term compared to its peers.

"There is the chance that Imperial may provide faster-than-expected earnings growth from a stronger-than-expected recovery in Western Europe or successful market share gains in the US, but equally its competitive position may see market share erosion over time."

Representing a 21% discount to JP Morgan's coverage, at 3,251p, Imperial has a 2016 price/earnings (P/E) multiple of 13.1 times. That's just a 5% discount on an EV/cash profit ratio of 11.7 times.

"However, the company has excellent cash generation and we forecast a 6.8% FCF [free cash flow] yield in CY16 and a dividend yield of 4.9%," said the analysts with a 'neutral' recommendation and 3,550p target price."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.