Bail out of Rolls-Royce

6th July 2015 14:06

What a way to start your career running Britain's largest and most iconic engineer. Warren East only took over at on Thursday last week, but already he's issued a maiden profits warning in an unscheduled announcement Monday. In truth, former chief John Rishton owns this one, which makes it three profit warnings in just 18 months on his watch.

Until last year, Rolls had gone a decade without downgrading expectations. But last February, Rishton said flat revenue and profit in 2014 was "a pause". Then, in October, he postponed the promised return to growth for another year.

Now, East - former boss of semiconductor designer and a non-executive director at Rolls - says underlying pre-tax profit will still be skewed more toward the second half this year, but annual profit estimates have been downgraded, too.

Rolls made £390-£430 million in the first six months of 2015 - we'll get the exact figure on 30 July. That's about 30% of full-year profit rather than the 40% recorded last year. And while annual revenue is tipped to remain unchanged, profit will be £1.325-£1.475 billion compared with the previous estimate of £1.4-£1.55 billion. East has also cancelled the share buyback after completing just half of the £1 billion programme.

"I am clearly disappointed by today's announcement and the impact this will have on our investors and employees," said East. "Notwithstanding the market developments, it is our responsibility to build a business that is sustainable and resilient no matter what is thrown at us and this will be my fundamental priority for the next few years."

The blame lies firmly at the door of the marine division, which supplies systems for oil rigs and rig supply vessels. The unit might make no money at all in 2015 and only £40 million at best. It had been tipped to turn a profit of £90-£120 million. Cost cutting and asset write-downs of £70-£100 million will also hit reported results.

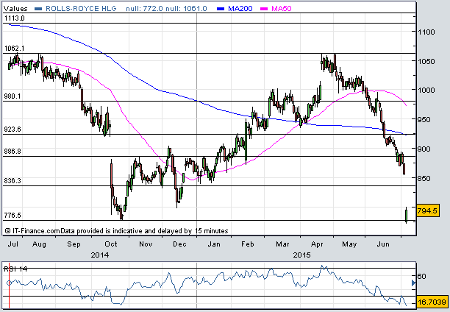

(click to enlarge)

But shortcomings at the huge civil aerospace business have more significant implications. Full-year results will come in as expected - look for revenue of £7-£7.3 billion and profit of £800-£900 million - but only one-off benefits have prevented a shortfall.

Rolls is delivering fewer-than-expected Trent 700 engines as buyers switch to the new Trent 7000. There's a pricing issue, too. Demand for engines to power business jets is also down and a softening regional aftermarket will also hit profits. But while the spares market for widebody jets is growing, results will be flattered by £200 million from a provisions release and improved retrospective contract profitability on long-term services deals.

And in 2016, the switch from Trent 700s plus the business jet slowdown will cost £300 million of profit at the civil aerospace division. It's anticipated that maritime profit will take another £85 million hit, too.

Rolls-Royce shares slumped by as much as 10% Monday and now trade at levels last seen in early 2012. In response, broker Panmure Gordon has cut earnings per share (EPS) estimates for 2015 from 59.2p to 55.4p. That still implies a forward price/earnings (P/E) ratio of over 14 times. Earnings will fall slightly next year, too, says Panmure's Sanjay Jha who still says 'sell' and cuts his price target from 744p to a miserly 600p.

Gold star to Deutsche Bank analyst Benjamin Fidler who downgraded Rolls shares to 'sell' two years ago and has cut his price target several times since. In May, he said Rolls - then trading at 1,013p - was worth just 645p a share. Right now, who'd bet against it?

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks