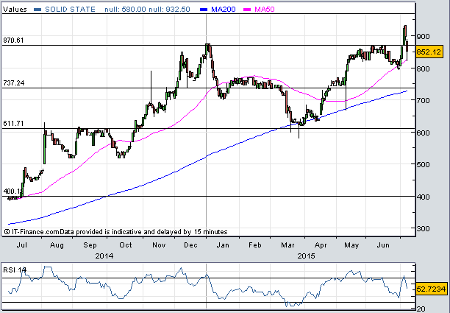

Rampant Solid State pauses for breath

7th July 2015 14:37

by Lee Wild from interactive investor

Share on

has been a favourite at Interactive Investor for a long time. A year ago to the day we said shares in the supplier of toughened computer products to the military among others were "worth a look". Well, they've more than doubled since, and a deal signed last year with the Ministry of Justice (MoJ) has the potential to be a real game changer.

Already, turnover in the year to March rose 14% to £36.6 million, generating pre-tax profit of £3 million, up 40%. Shedding about £2 million of low margin business inherited from its 2013 acquisition of 2001 Electronic Components meant margins rose to 8.4%. And the order book currently sits at a record £19.4 million.

Steatite, the unit which supplies bespoke lithium battery packs and the expensive antenna fitted to the Airbus A400m military transporter, grew profit by 9% during the period. It's the same division which won the MoJ contract worth £34 million over three years.

Solid State has just started supplying electronic tags at about £1,000 a pop. They're replacing the 30,000 or so old tags currently in use. But there's clearly room to develop the product which comes with GPS capability, and this could easily be a 120,000-tag market. Solid State's design team are already working on a range of devices for the medical sector and homecare, and there are obvious markets for anti-terror use and among dementia patients.

(click to enlarge)

There's interest from overseas, too - six countries, including Australia, Singapore and Taiwan have already shown an interest. MoJ billings reached over £2.1 million in the first quarter, but the first big benefit should be seen in the second half of the current financial year - £15 million, according to house broker WH Ireland.

Analyst Eric Burns leaves his forecasts unchanged, but still pencils in growth in sales of 56% to £57 million 63% surge in adjusted pre-tax profit to £5.3 million. With mid-single digit organic growth plus another £15 million from the MoJ, Burns reckons Solid will make almost £5.8 million in 2017.

Solid State shares have re-rated substantially since April, from 11.3 times 2016 EPS estimate to 15.2 currently at 852p. "Whilst a substantial medium term growth opportunity remains, the 45% increase in share price since then means that the valuation is more in-line with the peer group on 16x current year earnings," says Burns. "We therefore move to Market Perform, expecting the shares to consolidate in the absence of any new material drivers."

That makes perfect sense. But it's not the end of the story. The rating is not stretched, just high enough for now, and potential for further rapid growth is clear. Opportunities generated by the tagging contract will certainly be tied up quicker now that the initial development is done. Definitely one to buy on the dips.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.