Entertainment One a buy after hedgie Marwyn sells?

15th July 2015 11:31

by Lee Wild from interactive investor

Share on

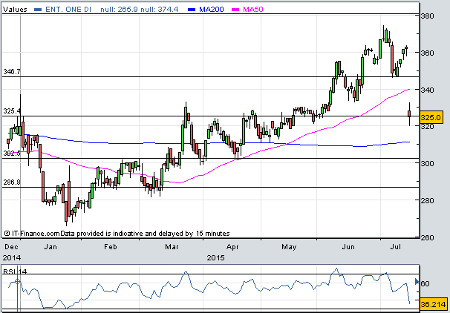

has been one of the stockmarket's star performers this year. Its shares had risen as much as 41% since January and have almost quadrupled since floating on AIM eight years ago. It is little surprise then that activist hedge-fund Marwyn Value Investors has sold part of its substantial stake. But an 11% plunge Wednesday seems harsh and the shares look good value.

Marwyn announced shortly after last night's close that it had instructed JP Morgan to sell 26.5 million eOne shares, or about 9% of the business. Now, we learn that institutional investors paid 330p a share for the stake, bagging Marwyn £87 million.

Of course, the share price slump reflects both the level of the placing and news that Marwyn has turned seller. Naturally, investors might be concerned that the remaining stake is up for sale, too. But Marwyn certainly appears committed to eOne.

Marwyn bought the company and listed it on AIM at the end of March 2007, raising £80 million from a placing at 100p a share. It joined the main market three years later, and even after this sale, Marwyn owns 52.9 million shares, or 17.9% of the firm.

And Marwyn's managing director James Corsellis appears in no rush to sell the rest. "This remains an important investment for Marwyn and we continue to be excited by the scale of the opportunity that faces Entertainment One going forward," said Corsellis, who has stepped down as an eOne non-executive director as a result of the sale. "Marwyn remains supportive of the management team and confident that they will continue to deliver on the eOne growth story."

(click to enlarge)

In any case, Marwyn has promised not to sell any more shares for at least 90 days, unless it receives the consent of JP Morgan. Even if it did want to offload another stake, it wouldn't do so unless it could get the right price. Marwyn is not a forced seller. It is an investor, and investors buy and sell stakes in companies.

But eOne does look good value - clearly the investors who snapped up Marwyn's shares thought so. In May we heard that it doubled profits last year and that it remains on track to double the size of the business within five years.

A member of Interactive Investor's Aggressive Summer Portfolio, we recently reviewed the share performance for June. Reaction to the previous month's full-year results spilled over into last month, and at 326p, Investec Securities said the shares looked decent value compared with North American peers like DHX Media and Lions Gate. It's why they upgraded their target price to 376p. Then, Numis Securities initiated coverage with an 'add' recommendation and target price of 401p.

True, there is always the risk that Marwyn will sell again, but for those willing to take the risk, a forward price/earnings (P/E) ration of 13 times appears undemanding.