Car dealers fuelled for further upside

17th July 2015 16:50

by Harriet Mann from interactive investor

Share on

In a sign that Britain's economic recovery is helping people's wallets, turnover in the UK motor industry hit a record £69.5 billion in 2014. But there is a much tastier investment case than the sale of new cars in this cyclical sector, one that is being ignored by the markets, says Fidelity's UK Smaller Companies manager Alex Wright.

On a valuation basis, the sector looks cheap against its broader retail counterpart. The four listed car dealers Wright holds - , , and - have an average forward price/earnings (P/E) multiple of 11.7 times versus the general retail industry's 16-17 times. But there's more to this than just valuation. Wright reckons there are two trends that should support the motor industry going forward - cyclical growth and structural change.

The recent growth in car sales has been a gradual process. The government's so-called "cash for clunkers" initiative in 2009 was an obvious boost to the new car market, and both economic recovery and low fuel prices since have helped increase car sales. This has opened up a number of growth opportunities in the sector.

New cars that enter the cycle are recycled as they get older, which is generally a three-year tale. This is good for motor companies as margins are much better on older cars and aftersales (servicing) is the most profitable element of the businesses.

The gross margin on new cars tends to be between 5-8% and used cars 8-10%, but aftersales come with a massive 45-65% gross margin, Wright explains. He reckons aftersales growth will last for some time, too, and warns that investors may miss this opportunity if they believe car numbers are the only growth drivers.

Structurally, the period of consolidation is upon is. The motor industry is incredibly fragmented, with many small dealerships competing against each other, but unable to invest for growth.

Pendragon and Lookers have the largest market share (around 10% and 4% respectively according to Wright), which means they have enough cash to invest in new technology and IT - that's crucial as more car browsing and deals are executed online.

Being able to market inventory attractively and move it around the country also means these bigger companies can steal market share organically from smaller peers. Clearly, M&A will make it easier for small dealers and will enhance the earnings of bigger rivals.

"So, there is a good cyclical change story, a big consolidation story and an organic structural growth story, all at incredibly low valuations. I think this continues to be a very interesting sector," added Wright.

So, which of the listed car dealerships are really worth buying?

Marshall Motors

180p

Investec: Buy, TP 215p

The fledgling of the group, Marshall Motors' raised £37 million when it floated in April to fund future acquisitions and invest in its existing physical assets and online offering.

The motor retail and leasing company operates Marshall Motors and Marshall Leasing, two integrated businesses that complement each other. With 71 franchise dealerships reflecting 24 different brands, Marshall has the highest brand coverage of any dealer in the UK.

After generating nearly £1.1 billion turnover in 2014, pre-tax profit of £12.9 million and reducing its net debt to equity ratio from 80% to 13%, momentum continued in the beginning of 2015. Analysts at broker Investec expect Marshall to report pre-tax profit of £10.1-£10.6 million in its August interims, supported by like-for-like growth in both new and used cars. Cash of around £34.4 million will also fund acquisitions.

Thanks to soft Chinese demand and a weak euro, the scene has been set for original equipment manufacturers to drive supply, and those companies that can't afford to keep up with these targets are expected to struggle, warns Investec's Alistair Davies:

"Marshalls is well placed with a key strength being its stockholding policy (56 days vs. 90 day industry average) minimising stock write-down risk and in our view leaves the group well placed to deliver further profitable growth from existing operations."

At 180p, the shares trade on 12 times forward earnings, which looks undemanding against prospects for organic and acquisitive growth. However, davies reckons EPS growth could stall from over 20% this financial year to 4.4% and 3.8% in 2016 and 2017 respectively, so Marshall will need to make the most of its cash to maintain growth momentum.

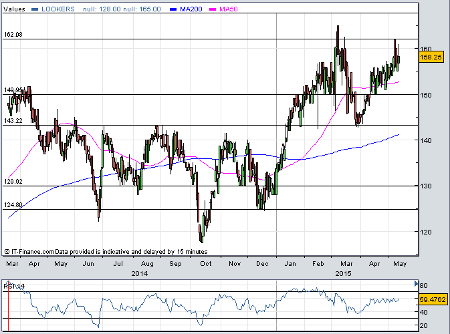

Lookers

159p

Panmure Gordon: Buy, TP 175p

Lookers shares still haven't quite regained all of their lost ground after sliding 6% at the end of last month. But after a good first quarter and earnings upgrades on the cards, the City has been quick to back the auto retailer. It's worth noting that since October, the company's market value had climbed over 40% to 167p, so the drop was likely profit taking.

The group has separate Motor and Parts divisions, with like-for-like growth, better margins and strong cash generation opening up acquisition opportunities across the two, says Panmure Gordon. Its aftersales business is expected to take-off with the cyclical environment and the group has worked hard improving customer retention and sales growth and managing its finances better. Management is confident in meeting full-year expectations, although these are thought to be conservative.

Panmure added: "Our 175p target price equates to 13x our FY2015 EPS estimate, which we believe is undemanding at this point in the cycle. We believe the current price [160p] represents an attractive entry point for investors seeking to gain exposure to premium margins and returns in the sector, and we reiterate our Buy recommendation on the stock."

Better-than-expected earnings and strategic acquisitions could trigger a re-rating.

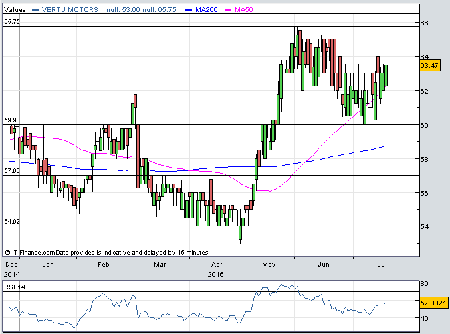

Vertu Motors

63p

Liberium: Buy, TP 100p

AIM-listed Vertu Motors hit the market at the end of 2006, enjoying a brief period above its flotation price of 60p, before crashing with the rest of the market in 2008 to just 10p. It's been a long slog back to its IPO price, but Vertu still trades at a discount and looks in good shape.

The group showcased better-than-expected full-year results in May, with strong cash generation allowing bosses to relax their dividend policy, which should boost future shareholder returns. Its overhead recovery continued in the year, despite heavy investment, and used cars stole the show with 9.2% growth. The update triggered profit upgrades.

Acquisitions have helped drive growth, with new Land Rover, Jaguar and Ford dealerships boosting earnings and diversifying its portfolio. A number of loss-making dealerships it acquired four years ago are now generating profit.

At 63p the shares trade on 11.5 times earnings, which appears undemanding given growth potential on offer.

"We see scope for significant share price appreciation from here as it continues to execute its successful growth strategy," said Liberium at the time of its full-year results. "Compiling the various valuation techniques used in the note, we average 107p per share, which ranges from 130p on our DCF including acquisitions to typical mid cycle EV/EBITDA multiples based on 2017E estimates at 82p."

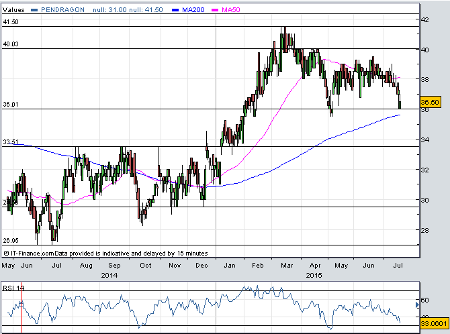

Pendragon

37p

Numis: Hold, TP 40p

Mirroring Wright's sentiment, management reckon new car registrations will be flat this financial year, with used cars experiencing 1-2% growth and aftersales taking the lead with 7% growth. Although sales of used cars supported earnings in the first quarter, the motor dealer's higher-margin aftersales operation is building steam and full-year profit is expected to grow by 8%.

Like the rest of the group, acquisitions are a crucial part of its growth strategy. In a bid to increase its US business, Pendragon expected a proposed acquisition of a Lexus dealership in California to be completed in June. Unfortunately, Lexus decided to purchase the dealership, so Pendragon will have to look elsewhere to tap into the growing new vehicle market there.

Still, its shares have surged by more than half to 42p this year, although demand has tailed off and the shares are approaching technical support at the 200-day moving average (see chart). The shares trade on 10.7 times 2015 earnings, a significant discount to the rest of the sector.

Numis said recently: "We view this as good value in its own right, but would reiterate our preference for Lookers, with its stronger underlying trading momentum and a more developed acquisition strategy for the same valuation."