Upgrades as Lloyds prepares Q2 reveal

22nd July 2015 17:25

by Lee Wild from interactive investor

Share on

publishes second-quarter results next week. Rebuilding his model ahead of the event, Deutsche Bank analyst David Lock has come up with a new share price target for the high street bank.

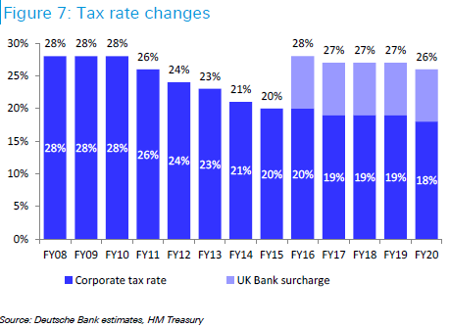

Adjusted earnings per share (EPS) estimates for the full-year are reduced by 3% to 8.1p, and by 13% and 10% for the following two years to 7.2p and 8p, respectively. An 8% tax hike from next year, the result of George Osborne's Summer Budget in which the chancellor announced the new surcharge on a bank's UK profit, is partly to blame. The deconsolidation of is worth about five basis points off net interest margin (NIM), and Lock also factors in Additional Tier 1 (AT1) costs.

(click to enlarge)

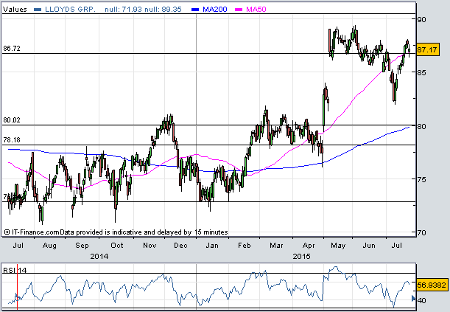

But even after these adjustments, Lloyds trades on a modest forward price/earnings ratio of 10.9 times and on 1.6 times tangible net asset value (TNAV). Deutsche pencils in a 14.6% return on tangible equity (RoTE) in 2015 and Common Equity Tier 1 (CET1) ratio of over 14%.

"We believe that a sum of the parts approach to valuing LBG is most appropriate, and we now take into account excess capital in 2017 over 13% CET1, as well as cash dividends paid up to 2017," writes Lock. "Discounted back this gives a target price of 100p, up from 97p previously."

"We remain positive on long-run capital returns at Lloyds given superior capital generative franchise and 5-6% dividend yield from 2016/7."

(click to enlarge)

Second quarter

Key numbers to look out for on 31 July include underlying pre-tax profit of £2.08 billion for the quarter, says deutsche. That's up a smidge on last year and gives £4.26 billion for the half-year. There's likely to be an interim dividend of 0.89p a share, too, part of the anticipated full-year payout of 2.5p.

Expect another £1 billion of PPI costs, says the broker, although of particular interest will be margin performance, tipped by Lloyds to exceed 255 basis points for the full-year. Deutsche, however, believes NIM is a volatile measure and prefers to focus on net interest income (NII) - it pencils in £2.9 billion for the quarter and £5.9 billion for the six months. Elsewhere, quarterly CET1 is tipped at 13.8%, rising to 15.2% in 2017.