Insider: Severn Trent, Pendragon

7th August 2015 09:17

We're into peak summer holiday season and most company directors will be sunning themselves on a private beach somewhere warm. But that kind of break does not come cheap, which might explain why it's sell orders that stick out in terms of both frequency and size right now.

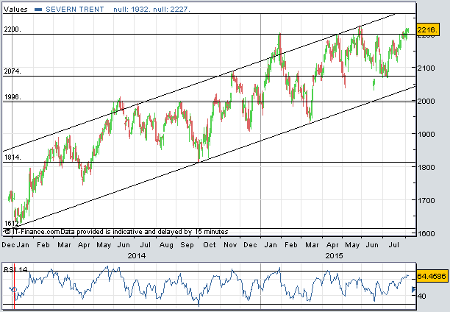

Severn Trent director springs a leak

has been a stunning performer in recent times, beating peers and by a wide margin over the past five years. There's been plenty of takeover rumour, too, with Severn oft touted as a target for Canada's Borealis Infrastructure. But one executive is still cashing in.

Former and Mars exec Andy Smith has just sold 7,423 Severn shares at 2,192p each, bagging £163,000. Smith, who last year moved from head of water services to MD of business services, and wife Sally now own 31,629 shares between them worth over £700,000.

It's been three weeks since Severn said there had been no change to its outlook following May's full-year results, and a decent first quarter means it's on track to hit guidance for the current financial year. The firm has made "very good" progress on delivering cost savings and confirms a dividend of 80.66p for 2015/16.

(click to enlarge)

Pendragon exec nets six-figure gain

Car dealer has a developed a habit of beating profit forecasts over the past few years, and that's reflected in the share price. They were trading at just 7.5p at the beginning of 2012, but had risen fivefold until Tuesday's interim results. We like the shares, but suggested a further catalyst would be required for them to break out of a tight trading range and establish new support above 41.5p.

Well, the catalyst came sooner than anticipated. Matthew Taylor at Numis Securities has upgraded full-year pre-tax profit forecasts by £4 million to £69 million, but admits even that may prove conservative. A solid auto retail sector backdrop should continue for at least a couple more years, too.

At 41p and trading on 11.4 times earnings per share estimates for 2015, Taylor said Pendragon shares traded at a 33% price/earnings (P/E) discount to the general retail sector despite the premium growth outlook. He upgraded the shares from 'hold' to 'add' and lifted his price target to 46p.

Well, Pendragon shares now trade at 45.5p, nudging an eight-year high, but corporate services director Hilary Sykes jumped the gun. Husband David Disney flogged 253,376 shares for £104,000 at 41.05p. They're currently worth an extra £11,000. Still, there's another one million Pendragon shares in their portfolio, and if Numis has undercooked forecasts, they could be worth far more.

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks