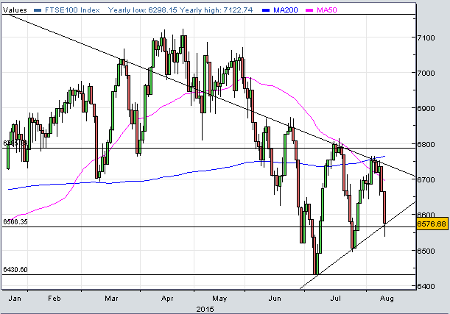

Chinese surprise wipes out FTSE 100

12th August 2015 11:54

by Lee Wild from interactive investor

Share on

It took the best part of a fortnight for the to achieve an improbable 260-point, or 4%, rally, but just a few bad sessions for the majority of it to unwind. China's decision to devalue its currency - the yuan, or renminbi - came sooner than the market had anticipated, and European companies exporting to China are at risk.

The so-called fix for the yuan was set at 6.3306 to the dollar Wednesday, down 1.6% on the previous day. The People's Bank of China (PBOC) had already cut the reference rate by 1.9% to 6.2298 on Tuesday, and means this is the biggest two-day drop since 1994. Analysts at Citi think the rate could hit 6.5 in the next 12 months, although others believe the devaluation could be as much as 10%.

Clearly, the decision has been influenced to some degree by disappointing data and a general slowdown in the local economy. Policymakers hope that devaluing the yuan will improve exports. But it's caused a surge in the dollar, which has had an obvious impact on other regional currencies. Equity markets are nervous, too.

(click to enlarge)

"European companies with significant Chinese businesses face potential translation and transaction risk under this new currency regime," warns Exane BNP Paribas. "We expect the initial 2% move to mark the start of a more pronounced depreciation.

"Added EM uncertainty is unhelpful. There are already signs the markets are pricing in a greater risk premium into US credit - and this is not just driven by commodity names. The divergence between the low implied volatility of equities and rising credit risk looks unusual. With a US rate cycle still looming, we feel there are downside risks to global equity markets."

Big-hitters like and the luxury goods sector - is down 8% - could struggle if this is the case. Instead, sector allocation should focus on the domestic sectors positioned to benefit from Europe's recovery, says Exane: "Our favoured plays include Banks, Real Estate, Retail, Construction and Telecom (the best defensive pick)."

Given the unpredictable nature of Chinese decision makers, it is likely markets will remain vulnerable. To understand why, it's worth looking at other possible motives for the PBOC's actions. It is no coincidence that the move comes just a week after the International Monetary Fund (IMF) report - "Review of the Method of the Valuation of the SDR - Initial Considerations" - which examined the conditions needed for including the yuan in its Special Drawing Rights (SDR), a global reserve made up of the dollar, euro, yen and pound.

"In the event of SDR inclusion, the Fund [IMF], in consultation with the Chinese authorities, would need to identify a market-based exchange rate that could be used as a representative for the RMB," said the IMF on 3 August.

"The new mechanism for determining the central parity of the renminbi announced by the PBC appears a welcome step as it should allow market forces to have a greater role in determining the exchange rate," said the IMF in response to China's move. "The exact impact will depend on how the new mechanism is implemented in practice."

But it's the speed of China's currency intervention that shocked traders given the IMF has only just proposed sticking with the current SDR basket until 30 September 2016. "We didn't think they [the Chinese] would reform fixing until after November," said Citi. "We were wrong."

Deutsche Bank strategist Jim Reid is concerned, too.

"Every day when I wake up and think about the EMR [Deutsche's Early Morning Reid report], the first thing I do is check whether China have devalued as it was one of our risk factors in our start of the year outlook and something that has been a real threat for a while," he says.

"The reason I think this could be a big deal is because it may mark the point where the global currency wars move from being friendly to being more antagonistic. Clearly the China moves so far are minor but do seem to mark a change in strategy which is the important point."

There are also implications for US interest rates, and the chance of a hike in September has dropped from 54% on Monday to 40% currently. "So one has to balance the risk of a destabilising currency war with the extra global liquidity it would bring," writes Reid. "Net net we still think the global financial system is incredibly fragile and essentially being artificially propped up by mass liquidity. This view hasn't changed yet but the risk of something more destabilising depends on China's likely follow-through."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.