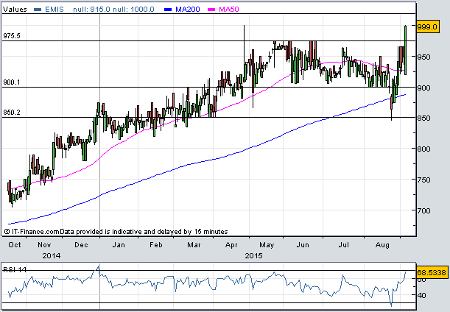

Chart breakout at healthy EMIS

4th September 2015 12:40

by Harriet Mann from interactive investor

Share on

, which had already flagged in-line trading during its first half, has now confirmed it is fit and healthy, with earnings growth showcasing progress across all its businesses and bankrolling a tasty boost to the dividend. And the future also looks promising for the healthcare software company, given strong visibility and further acquisition opportunities.

Trading in the first six months of the year matched forecasts, with 17% growth in sales to £77.8 million and adjusted operating profit up 16% at £16.9 million. With more cash being generated from operations, up 2% at £27.5 million, and net cash reaching £1.3 million, management have hiked their dividend up 15% at 10.6p. Adjusted earnings per share rose 18% to 20.5p.

After surging 7% to 999p on Friday and up 15% from recent lows of 845p, EMIS shares have broken out above previous technical resistance at around the 975p level and now trade on 22 times forward earnings. Over the last 12 months, the software firm's market value has risen by a third to £606 million. After announcing its acquisition of Pinbellcom in July, Panmure Gordon analyst Adam Lawson has gone over his sums and now reckons each EMIS share is worth 1,063p, 2% higher than his previous target price and 9% higher than current levels.

There's certainly been progress across the group, although primary care is stealing the show. It has 54% market share and its web roll out programme was completed in England and Wales. With the programme in Northern Ireland ongoing, 4,431 practices are now live. The firm's community pharmacy division managed to maintain its profitability, while also investing in development, with its next generation of software set to be trialled in late 2015. Organic growth in secondary and specialist care was slower, but last year's acquisitions of Indigo 4 and Medical Imaging are performing well.

(click to enlarge)

With a strong order book, revenue visibility and higher recurring sales, EMIS is justifiably optimistic about the second half. Eyes are on growth opportunities within all divisions and the group reckons the UK government's pledge to have all electronic health records available in every care setting within five years will be a boost.

"We continue to believe that the over-arching theme of digitisation of healthcare, driving both improved outcomes and lower costs, and heavily supported by UK government policy, remains a strong following wind for EMIS," said Numis Securities analyst Will Wallis. "In addition to solid prospects in the large GP software & services business and continuing momentum in CCMH, we see excellent prospects (all potentially ahead of our forecast assumptions) from Community Pharmacy (potential market share gains and additional products), eye screening (leader in a market just embracing outsourcing with strong momentum), and Patient (revenues currently small but potentially very exciting), and we think our Secondary Care margin forecasts may be conservative."

"We think EMIS has almost unparalleled visibility of organic growth within the UK software sector (we model +7% CAGR 2015-17 with risk to the upside), and a strong track record of value creation from bolt-on acquisitions," says Wallis. "The shares remain our top pick in the sector."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.