UK suppliers caught in VW fallout

25th September 2015 10:10

by Lee Wild from interactive investor

Share on

Almost three years ago I wrote a piece about the European car industry; it began "European Carmageddon". The Book of Revelation seemed appropriate given demand for new cars in Europe had just plunged to an 18-year low, and manufacturers were struggling. It was clear, however, that UK suppliers could weather the storm. They did. But now, the scandal poses a further serious yet unquantifiable threat.

VW Group chief executive Martin Winterkorn has already lost his job, and others at the world's second-largest motor company will probably follow. Installing software designed to cheat car emission tests has rocked VW, previously a byword for quality and reliability for decades. That reputation currently lies in tatters.

And what's disturbing right now is that the scale of the crisis is unknown. VW admits to 11 million diesel engines being affected worldwide. By its own admission, then, this is not, as first thought, confined to the US, but the tip of the iceberg.

It's not just confined to VW either; contagion has spread throughout the industry. As well as VW, which owns Audi, Seat, Skoda, Bentley, Bugatti, Lamborghini and Porsche, the other big German manufacturers are now under the microscope. Shares in rivals and Mercedes-owner are off sharply. New tests at BMW are raising concerns.

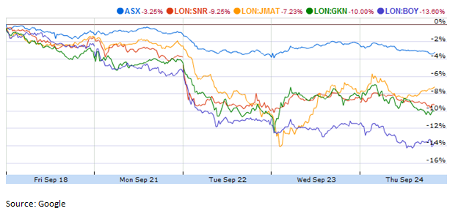

Rightly, or wrongly, shares in UK-listed suppliers are down heavily, too.

That's understandable. A switch to non-German manufacturers would certainly damage business, and we just don't know what the impact on sales of VW and its stable of marques will be. In truth, it may be quite small, and this could all be an overreaction. VW will surely survive this following a period of short-term pain.

(click to enlarge)

It's what makes companies like , , and look interesting. All supply Volkswagen with different parts and services, and any dip in VW sales could put a dent in revenue all round.

We reported earlier this week that catalytic convertor giant Johnson Matthey had slumped, with investors linking the company with the VW scandal. GKN is also on the rack, unsurprising given that VW is the largest customer at GKN's division which supplies drivelines to car manufacturers, making up 15% of sales. VW also does business with other parts of the UK engineer.

Bodycote, meanwhile, has lost 12% of its value this week and currently trades at a two-year low. Its heat treatment processes for brakes, pistons and other parts are used by many of the big car companies. And Senior may make parts for Black Hawk helicopter and fighter jets, but its Flexonics division also supplies flexible automotive components, mainly for diesel engines. Peugeot, Renault, Ford and General Motors are big customers.

Others like sell nuts and bolts to the likes of Nissan, Jaguar Land Rover, Audi and Volvo, while supplies Volkswagen, BMW, and Daimler with electronic components and sensors - its shares have fallen as much as 12% in the past few days.

Experts have been quick to downplay the "excessive" reaction over the past few days. UBS thinks the impact on GKN of any action taken against VW "is likely to be trivial". A 10% slump in VW sales would nip 0.7% off both the top and bottom line at GKN.

(click to enlarge)

And Martin Dunwoodie at Deutsche Bank believes Johnson Matthey has been treated harshly. The analyst estimates that of the £2 billion of sales from the catalyst business, a third will be from light duty diesel. Losing all of that work - unlikely in reality - would cost £97 million of operating profit, equivalent to 20% of group profit and a 21% hit to earnings per share (EPS). An implied price/earnings (PE) of less than 16 is way below the historic average and perhaps explains why Deutsche thinks the shares are worth more like 3,500p rather than 2,400p.

"Although uncertainty is likely to weigh on the stock short term we see good long-term value in Johnson Matthey," concludes Dunwoodie. It is worth noting, however, that while Charles Pick at Numis Securities rates the shares as 'add', he plumps for a more modest target of 2,650p.

(click to enlarge)

Clearly, the Volkswagen crisis will have serious repercussions for the global automotive industry. It will rumble on for months, possibly years. There'll be more sackings, criminal investigations, huge fines and self-flagellation. VW's profits will suffer, and those of suppliers might, too.

Yes, work for aerospace and defence customers will cushion the blow, but share prices had turned south long before VW. Margins have peaked, and the outlook for earnings has been a concern since the spring. Having nudged absolute highs in June, valuations also remain at the higher end of the range, despite a sector de-rating (see chart above).

A weak euro has blown a hole in profits, too, and with the six-year recovery following the financial crisis over for now, investors will likely demand evidence that Europe continues to rebuild and China is not about implode. Until then, there is little to suggest engineering stocks will outperform.

Other sectors, however, stand a much better chance of beating the market in the months ahead. Edmund Shing, global head of equity derivative strategy at BNP Paribas, reveals them here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.