InternetQ shares tipped to double

30th September 2015 11:57

by Lee Wild from interactive investor

Share on

owns mobile marketing platform Minimob and a big stake in music streaming service Akazoo. It grew revenue by 10% in the first half of 2015 and underlying pre-tax profit at the Athens-based company jumped by 24% to €7.4 million (£5.4 million). In July, private equity firm Penta Capital and hedge fund Toscafund Asset Management invested €17 million in cash into Akazoo. Business is good, and we thought so last year when we highlighted the shares. They subsequently rose 60%, but the market crash has hit hard and they look like a bargain again.

Revenue from mobile marketing on behalf of mobile companies, games publishers and brands rose 8% to €55.5 million. But Minimob smartphone ad-serving revenues surged by 400% to €35 million. Latin America was up 46% to €17.5 million, but there was growth all round – there were client wins including Baidu and WeChat in China, and Gumtree and Samsung in the US - and adjusted operating profit leapt 19% to €9.6 million.

And at Akazoo, which competes with big-hitters Spotify and soon-to-IPO Deezer, sales grew by 16% to €16.5 million. Adjusted operating losses narrowed significantly to €222,262 from over €1 million a year ago, and management tells Interactive Investor that its focus on further pay-only music streaming services gives it an advantage as the market shifts away from free content. It's heavily focused on emerging markets too.

But a crucial event for InternetQ also has implications for its valuation. Over the summer, a consortium led by Toscafund and Penta Capital pumped €17 million into a UK registered entity that will hold the Akazoo business. The division also now includes music recommendation and profiling engine R&R Music. The implied post-money valuation of the enlarged debt-free Akazoo business was €104 million, with InternetQ holding 69.1%.

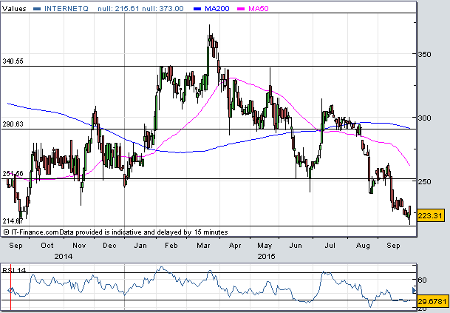

(Click to enlarge)

The money not only provides capital for expansion, but places an accurate value of €72 million (£53 million) on InternetQ's stake in Akazoo. Remember, InternetQ's market capitalisation is only £88 million.

Yes, there will be a €3 million hit to Akazoo's cash profit – a mix of R&R overheads and investment – which means broker Canaccord Genuity has cut cash profit estimates for 2015 from €28.9 million to €25.9 million, and EPS from 42.8 euro cents to 36.2c. Numbers for 2016 are unchanged, and increase for 2017, giving EPS of 61.8c.

"The increased investment in Akazoo should yield a rapid payback and enhance the valuation of the music business," writes the broker. "Strip out Akazoo, and the implied [market value] for mobile marketing is just €51 million, representing a 2016 PE of 2.6x and EV/EBITDA of just 1.2x."

Include the whole business and the shares trade on just 8.4 times earnings for 2015 and 5.6 times enterprise value/cash profits (EV/EBITDA). That drops to 6.3 times and 4.2 times on 2016 numbers.

Canaccord thinks the shares are "materially undervalued" and worth 528p. That would only put them on 15 times earnings for 2016 and EV/EBITDA of 8.5 times.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.