HSBC shares have fallen too far

30th September 2015 17:18

by Harriet Mann from interactive investor

Share on

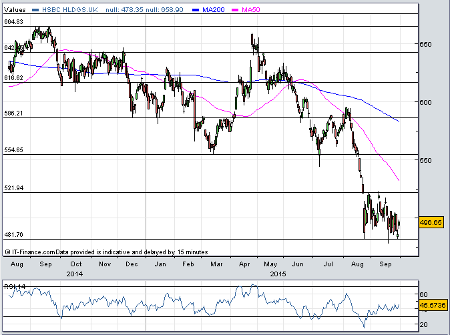

Fuelled by the People's Bank of China's decision to weaken its currency in August, nearly $30 billion has been wiped from market capitalisation since. The shares have lost a quarter of their value in the past five months and sit near a four-year low, but, with the commercial bank now looking cheap, one City analyst has upgraded its rating and reckons patient investors should snap the shares up now.

"We believe the market has de-rated the Asian franchise to a multiple of just 1.2x tangible book for a business that we expect to make a 16% [return on tangible equity (RoTE)] this year," says broker UBS. Reflecting earnings downgrades, HSBC's target price has been trimmed to 550p, but the bank's headline yield of 6.8% provides support and looks sustainable.

Within HSBC there are a number of attractive businesses with high return potential, according to UBS. In both the UK and Asia - which generated 70% of the group revenue last year - as much as half of HSBC's earnings aren't performing in line with historical returns.

(click to enlarge)

"We see considerable scope for further group restructuring to free up capital and shrink the business back into its higher return footprint," explains analyst Stephen Andrews. "A tougher macro backdrop may even accelerate this process. Post years of de-risking we view the group's high return businesses as 'liability' driven which gives them leverage to rising rates in both the UK/US."

Of course, there are a number of obstacles which could limit progress.

After nearly a decade of de-leveraging, HSBC's sustainable return on equity (RoE) has been significantly reduced and its regulatory backdrop continues to morph. Investors should be keeping an eye on risk weighted asset (RWA) inflation, which Andrews reckons could offset some of the group's total RWA reduction programme. News that Swiss officials are investigating HSBC for price fixing in the precious metals market is also unwelcome.

However, with a generous dividend underpinned by an impressive common equity tier 1 ratio (CET1) - it's tipped to be above the top end of its target range of 12-13% by the end of 2016 - RWA reductions at its global banking and markets (GBM) division will help strengthen this indicator of financial strength further. The group revealed plans to cut its RWAs by around $290 billion in June, with $140 billion coming from its investment bank.

Although sales are expected to fall 2% to $59.8 billion this financial year, UBS expects pre-tax profit to jump by around a fifth to $22.2 billion, giving net earnings of $14.5 billion. With earnings per share of $0.74 forecast, the shares currently trade on 10 times forward earnings. As we said in August, there is a strong chance we will have to wait for interest rates to rise before we see a more significant shift in the share price. Andrew agrees that value is emerging for investors, as long as they have patience.

"We expect a broadly flat dividend which gives the stock a post scrip yield of c5%. While there are headwinds and limited obvious catalysts in the short term we do now see value in the shares," the analyst concluded.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.