Muted reaction to SABMiller mega-bid

7th October 2015 11:06

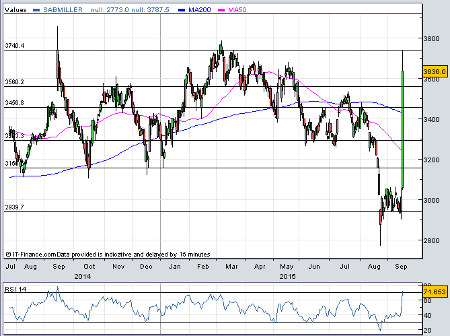

What's going on? The world's largest brewer has gone public with a proposed £68 billion mega-bid for its nearest rival , but the shares have hardly twitched. They're up just 1% and trading at £5.50, or 13%, less than the offer price. While the market is not exactly pricing in failure, neither is it pricing in a better bid, or a swift conclusion.

We hear Wednesday that Anglo-South African giant SABMiller – the Stella Artois, Budweiser and Corona lager firm – has received four bids from AB InBev. A "disappointed" Belgian brewer said a £38 offer and another at £40 made two weeks ago had been rejected. Now, SABMiller says a proposed £42 per share cash bid made on Monday "still very substantially undervalues SABMiller".

Today's offer of £42.15 is being considered, but an extra 15p will not swing it. Goldman thinks SABMiller could go for almost £50, and earlier this year UBS estimated AB InBev would be able to create economic value at a price between £36 and £40.

"AB InBev believes that this revised proposal should be highly attractive to SABMiller shareholders and provides an extremely compelling opportunity for them," the brewer wrote Wednesday. It certainly is. The offer is a premium of 44% to the £29.34 share price the day before big speculation broke. It's also more than SABMiller shares have been worth, ever.

That's got to be tempting for shareholders, but comments from SABMiller chairman Jan du Plessis are not promising. He says:

SABMiller is the crown jewel of the global brewing industry, uniquely positioned to continue to generate decades of standalone future volume and value growth for all SABMiller shareholders from highly attractive markets. AB InBev needs SABMiller but has made opportunistic and highly conditional proposals, elements of which have been deliberately designed to be unattractive to many of our shareholders. AB InBev is very substantially undervaluing SABMiller.

This is not a case of squeezing a few pence more out of AB InBev. However, knock back another offer and there is a risk that the Belgians will walk away. Its pockets are deep, but this takeover will require huge amounts of debt. More debt could prove a millstone round the neck of the enlarged group.

And SABMiller management made their intentions quite clear when they brought forward a second-quarter trading update - essentially a defence document - to Tuesday.

"Growth accelerated in the second quarter of the year, underpinned by our unmatched footprint in the growing beer markets of the world," wrote a defiant chief executive Alan Clark. "We have a strong business with exceptional long term prospects."

Organic net producer revenue (NPR), which strips out excise duties and other taxes, rose a better-than-expected 6% in the three months ended 30 September, although a strong dollar actually meant reported sales slumped by 9% in both the quarter and the first half.

Crucially, SABMiller's largest shareholder backs the deal. Tobacco giant Altria, owner of Philip Morris and maker of Marlboro cigarettes, has a 27% stake in the business. It says:

Altria believes that a combination of these two companies would create significant value for all SABMiller shareholders. Altria supports a proposal of £42.15, or higher, with a partial share alternative, and, subject to finalization of terms, would be prepared to elect the partial share alternative. Altria urges SABMiller’s board to engage promptly and constructively with AB InBev to agree on the terms of a recommended offer.

AB InBev has included a partial share alternative, currently worth £37.49 a share, which is clearly aimed at both Altria and BevCo Ltd, which owns about 14% of SABMiller shares. This part of the offer is capped at 41%, the total stake held by the big two.

The ball is firmly back in AB InBev's court, but its next move has must be significant. As SABMiller points out, the current deal only values the company at 14.7 times cash profits for the year to March 2015, "a significant discount compared to the multiples for comparable transactions".

What about the share price then? Well, even if a deal goes ahead, the time to completion and regulatory approvals required mean the shares will trade "at a sizable discount to any takeout price," says Simon Hales at Barclays.

However, if it falls through, SABMiller shares are unlikely to trade above £42 any time soon, either. There are concerns about growth in emerging markets, and SABMiller shares are hardly cheap, despite what management thinks. A forward price/earnings (PE) ratio of around 25 times is pretty rich and, as Hales says, "leaves little room for error".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks