Top analyst's 10 small company shares to buy

16th October 2015 12:41

by Lee Wild from interactive investor

Share on

Like all investors, the big investment banks have their favourites. It's no different at JP Morgan where the team of analysts has sifted through their research notes and come up with a top 10 of UK small and mid-cap stocks.

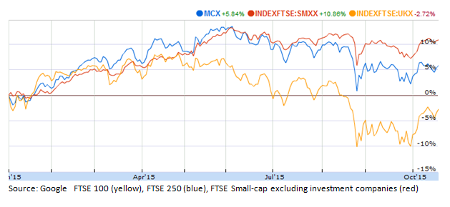

So far this year the small and mid-cap plays have performed largely in-line with JP Morgan's expectations. The smaller guys are now way ahead of the mid-caps, and both are embarrassing the FTSE 100 blue chip index (see chart below).

"While we remain concerned about [emerging market] Asia, we believe the UK and US to be sufficiently far from cycle peaks to resist contagion and continue to see upside on a 12-month view despite risks of a volatile October," it says.

(Click to enlarge)

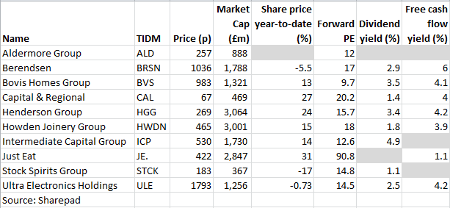

Out of the 156 stocks it covers, the broker has picked out its top 10. Remarkably, there are nine new names in the list.

Challenger bank got its float away in March after raising £75 million at 192p a share. They're up a third since and JP Morgan likes the 22% loan book compound annual growth rate (CAGR) in underserved markets. That translates into four-year pre-tax profit CAGR of 31%.

, the protective clothing-to-hospital linen firm, is under new management and chief executive James Drummond is expected to flag up a strategic review in November. JPM thinks a solid balance sheet may allow capital return.

Housebuilder offers sustainable double-digit earnings per share (EPS) growth at a forward PE ratio of just 10 times, while UK shopping centre-owner trades at a 19% discount to net asset value (NAV) estimates for 2016. Asset management initiatives can drive rental growth, too, says JPM, and there's potential for M&A.

Fast-growing fund manager has preferred developed market equity exposure and is a "steady yielder". Beta, a measure of volatility, or sensitivity to fluctuations in the wider market, is also down 13% from its 2015 peak.

(Click to enlarge)

Kitchen supplier had net cash of £223 million in June and a free cash flow yield of 4% funds 20% dividend growth. It's a consumer play and "market share taker", says JPM. , one of the world's largest mezzanine finance specialists, is another to watch. Return on equity is tipped to rise with assets under management, and 20% of its market capitalisation is expected to be returned in the next two years.

Fast food internet hub is growing fast, driven by structural trends, network effects and M&A. It only listed last year, yet already generates an estimated 1.9% free cash flow yield in 2015, says JPM.

has a short history as a listed company, too. The Central and Eastern European branded spirits producer floated at 235p two years ago, but has run into problems – it issued a profits warning last year following a duty increase in Poland and price war, which hurt margins. However, JPM thinks that the worst is over and that the shares offer the best value/growth in the sector.

rounds off JPM's top 10. The company is big in cyber security and civil aerospace, but its bread and butter has been high-tech systems for military buyers, things like torpedo defence systems for submarines. JPM believes we're at an inflexion point in western Europe defence markets, and that Ultra is a play on cyber security.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.