New tech IPO Softcat looks promising

19th October 2015 14:36

by Lee Wild from interactive investor

Share on

Staff at Softcat are a lucky bunch. Not only has the UK software reseller been named the second-best place to work in the country, it's just announced its intention to float on the stockmarket next month, triggering a windfall for top brass. The £500 million company is grabbing market share from rivals, too, and both revenue and profit are growing fast. This IPO looks very interesting indeed.

Softcat was established by Peter Kelly in 1993, and within four years had become the largest supplier of Microsoft software licensing in the UK. Kelly still owns 52% of the company with an estimated value of around £250 million. Now, the firm provides a suite of products and services to small and medium-sized businesses, and also for much larger businesses and for public sector customers.

And there are plenty of reasons to be optimistic. In terms of the numbers, Softcat's customer base has tripled since 2007 to 11,413, and average revenue per customer has increased at a compound annual growth rate (CAGR) of about 35% in the past six years to over £52,000.

Revenue has risen ten-fold in the past decade with an incredible 40 quarters of uninterrupted organic revenue growth since 2005. In 2007, Softcat generated just £89 million of sales, but by 2010 it was £146 million. In the year to July 2015 it was an incredible £596 million. Meanwhile, adjusted operating profit has risen from £28 million in 2013 to £40.6 million this year. Clearly, management had an eye on the IPO prize.

There'll be a dividend, too.

Softcat is highly cash generative - average cash conversion for the past three years has been 109% - and average return on invested capital was 38%. It's sitting on net cash currently and intends to pay an annual dividend of 40-50% of profits after tax - £31.1 million in 2015, up 14%.

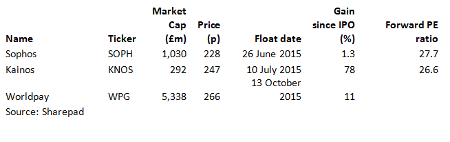

(Click to enlarge)

And Softcat comes to market with a heavyweight board packed with experience. Chief executive Martin Hellawell joined Softcat as managing director in 2006 before taking the top job last year. And he's no stranger to IPOs. Hellawell was at for 13 years and formed part of the team that floated the business in 1998. He owns 12% of Softcat.

Chairman Brian Wallace has been there for four years and took his current job 14 months ago. Before that he'd been finance chief at and . Softcat's top number cruncher Graham Charlton, who joined in January this year, spent four years as finance boss at comparethemarket.com.

And non-executive directors Lee Ginsberg and Peter Ventress are familiar faces in the City. Ginsberg was finance chief at for a decade, and Ventress, who only joined Softcat this month, ran protective clothing-to-hospital linen firm Berendsen. He's still a director at both and electronics supplier .

That Softcat is floating in what remain volatile stockmarket conditions does demonstrate both confidence and bravery. There have been relatively few technology IPOs this year and statistics from accountancy giant PwC show a definite lack of big-ticket IPOs during the first half of 2015. PwC attributes this to "market volatility and the increasing number of start-ups with billion-dollar valuations".

According to PwC stats, 36 technology companies went public during the second quarter to June, raising $6.2 billion. But despite a 57% increase in the number of tech IPOs over the first quarter, proceeds were flat. US wearable fitness device firm FitBit was the most successful, pocketing $841 million.

Indeed, potential blockbusters like controversial taxi app firm Uber and American cloud storage company Dropbox just haven't happened. In fact, they look no closer to listing than they did at the beginning of the year.

Dropbox has said it wants to build up its base of paying customers which currently make up just a fraction of the company's 400 million users. And leaked documents recently revealed that Uber, the $50 billion company believed to be significantly loss-making still, will delay its float for 18-24 months. Avoiding public scrutiny of its books while it addresses adverse publicity and fierce competition probably makes sense to its secretive board. It also means no need for time-consuming quarterly financial reports.

Clearly, others think the same. Instead of spending millions on a stockmarket listing and all the paraphernalia that entails, they're getting cash from venture capital investors and pumping it back into the business.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.