Lok'nStore still undervalued

19th October 2015 14:51

by Harriet Mann from interactive investor

Share on

As well as successfully executing rapid store expansion, cutting costs and reducing debt, self-storage firm dividends are up, too. And they have plenty of room to grow. We've backed the shares for some time, and despite hitting an all-time high, they continue to trade at an "unwarranted" discount to larger peers.

Up 10.9% and ahead of expectations, revenue reached £15.4 million in the year to 31 July, generating pre-tax profit of £2.7 million, up 35%. Good cost control improved its margin by three percentage points to 53.7%.

The company has added new Reading and Aldershot stores to the mix, there'll also be a new Chichester store by the end of the year. Southampton and Bristol open next spring. "We have been opening a lot of new stores and we will be continuing to open a lot of new stores both purpose-built freeholds and managed stores on behalf of other investors," boss Andrew Jacobs told Interactive Investor. "That's been helping drive the growth of the business, and will continue to."

Management also want to manage more stores for third parties and expand the document storage business - sales were up 6.5% in the year. The group spent £3.3 million on investment in the period, down from £6.4 million the year before.

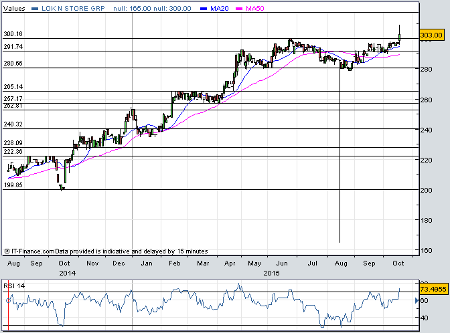

(Click to enlarge)

Despite investing heavily in new stores, Lok'nStore is a "very conservatively geared business". Bosses have managed to bring net debt down to £25.2 million and its loan to value ratio from 28.2% to 25.8%.

With funds from operations jumping by a quarter to £4.98 million, a strong operational performance, lower debt and "clever funding mechanisms" have allowed the group to bankroll its rapid development programme while sticking to its progressive dividend policy. This year, bosses have upped the pay-out by over 14% to 8p per share. Growing from 5p, management have showcased "steady, predictable progress".

Explaining the group's "clever funding mechanisms", Jacobs says:

"When we opened the Reading store in the late 90s it was a leasehold store. Over the years we have managed to acquire the freehold of the store which gave us access to the site on the other side of the road. We managed to achieve planning permission for residential development on the old site, which we then sold and the proceeds allowed us to build a lovely smart new store on the other side of the road, with some money to spare."

Next year is looking good for the balance sheet, too. A further £2 million has been received on the sale of its Reading store and it's sold the Swindon store for £3.5 million.

Jumping 3% to an all-time high of 305p, Lok'nStore shares have finally broken the 300p barrier they've been testing since June. The trade on a heady 30 times 2016 earnings estimates, although net asset value (NAV) is the key valuation metric here. Upgrading 2016 NAV forecasts by 6% and EPS by 3%, finnCap analyst Guy Hewett thinks the shares are worth more.

"We continue to value the shares at a 25% premium to historic NAV," says Hewett. "This compares with Big Yellow at a 35% premium and 30% for Safestore. Rolling forward a year, this now equates to 378p (27% upside) up from our previous 339p target."

Chief executive Andrew Jacobs agrees. "We trade at a heck of a discount to our quoted peers and yet we are growing our business, which those guys aren't, so we find ourselves in an interesting position."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.