High-yielding BHP Billiton impresses

21st October 2015 14:47

by Harriet Mann from interactive investor

Share on

To say it's been difficult for miners recently is an understatement. Economic weakness in China and plunging commodity prices has put the sector through the wringer. In little more than 12 months, shares have halved in value. But the heavyweight digger is slashing costs and first-quarter production figures prove it's on track to meet full-year forecasts. It's why traders are nibbling at the shares on Wednesday.

As onshore US gas field are mothballed, petroleum production fell 4% to 65 million barrels of oil (mmboe) in the three months to 30 September. Copper production went the same way, down 3% at 377,000 tonnes (Kt) as lower grades at the huge Escondida copper mine in Chile offset a better performance elsewhere. These numbers suggest BHP is producing with a 25-27% run-rate of full year guidance, says Barclays.

Ramping up its Western Australian Jimblebar mining hub pushed BHP's iron ore production up by 7% to a record 61 million tonnes (Mt). Full-year guidance is unchanged at 247 Mt. while metallurgical and energy coal stayed flat year-on-year at a tad at a little either side of 10Mt each.

"BHP Billiton remains on track to meet full-year production and cost guidance after a solid operational performance this quarter," said chief executive Andrew Mackenzie. "In petroleum, we continue to reduce costs in both our Onshore US and Conventional businesses, and will meet our production targets with $200 million (£129.5 million) less capital investment."

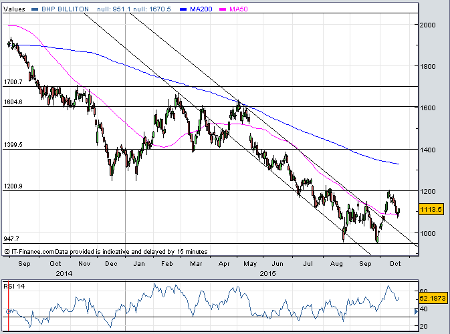

(click to enlarge)

Although the company is cutting capital expenditure (capex), BHP's four major projects in petroleum, copper and potash – they have a combined budget of $7 billion - are on track, too.

While miners remain largely unloved, contrarian investors have dipped their toes back in recently, and BHP has received City backing.

"On our estimates, BHP sports the highest margins among the diversifieds, best liquidity, high returns plus a long energy position and a sector leading yield," explains Barclays. "We believe it offers protection against sector underperformance."

During the wider market sell-off, BHP shares fell 42% to a low of 951p late last month. The shares have broken out of a downward trading channel since (see chart), but have met new resistance at 1,200p. Barclays reckons BHP could be worth 1,580p, representing 42% upside to current levels. It would be much more if commodity prices rebounded. Conversely, another crash would make a new low of 948p highly likely.

VSA Capital is a fan, too: "BHP remains our preferred pick of the majors since it has the highest level of exposure to China's major structural shorts; oil, copper and iron ore. Furthermore, production performance in copper has been stronger than , in our view, since the operational issues have been confined to Escondida."

There does, however, remain a question mark around the dividend. Many think BHP will keep paying out at the current rate at which the shares yield over 7%. Others do not and believe the money saved from halving the payout would be better spent elsewhere.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.