Share of the week: Meggitt down but not out

6th November 2015 16:15

by Lee Wild from interactive investor

Share on

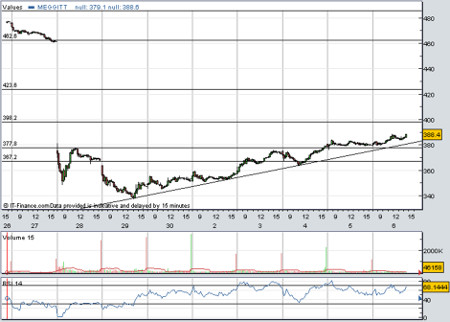

It seems odd picking as Share of the week. A third-quarter profits warning late last month pounded the defence contractor and plane parts engineer, and within a day more than 26% of its value had been wiped out. But it's a quality operator, and there are plenty of investors betting that this is a one-off. Whether it is or not, a 10% rally since Monday makes Meggitt worthy of further investigation.

Perhaps we shouldn't be surprised that Meggitt has done so well in the past few days. As early as Monday, our own technical analyst John Burford predicted "a relief rally is likely near-term".

Of course, the key question for investors now is whether this is the first of a series of warnings over the next few months. Often, once the rot creeps in, companies end up issuing further warnings - historically, three is the favourite. Indeed, research shows that about three-quarters of firms which warn once will do so again.

John thinks Meggitt shares could be heading for 300p, suggesting this week's jump has all the hallmarks of a "dead cat bounce". But plenty of investors have found the share price plunge to a four-year low too tempting, perhaps with the intention of turning a quick profit.

(click to enlarge)

Not so directors. They typically buy for the long-term, and in the aftermath an army of top brass bought around a quarter of a million Meggitt shares at between 348p and 355p. Chief executive Stephen Young, whose wife just spent £352,000 on shares in the company, warned of "a marked deterioration in September". Weaker-than-expected demand for spare parts used on commercial jets, for military equipment and in energy markets, easily offset an increase in sales of original equipment for civil aircraft.

Expected to continue through the fourth quarter, and with lower volumes and programme deferrals also hitting margins, full-year underlying operating profit will be "meaningfully below" consensus forecasts of £369 million - analysts think that means an 11% cut to expectations. It also means net debt will also exceed the 2.1 times cash profits estimate.

In John's article, he also warned against paying too much notice to City analysts. Only days before Meggitt's warning they'd been queuing up to sing its praises. Few, apparently, had a clue what was coming.

However, it's still worth looking at what they think now, if only to use as a guide to how Meggitt's actual results stack up against expectations. That in turn will determine how the share price behaves.

For the record, Barclays remains über-bullish: "Rarely do we find [aerospace & defence] companies which are simply too cheap, but post last week’s warning MGGT is firmly in that bracket.

"At 10x FY16 P/E, 9x EV/EBITA with a comfortably affordable dividend yielding c4.5%, the shares trade at a 25% discount to their own historical averages vs. the sector in spite of a 6% EPS CAGR and unmatched cash progression." Price target is 420p.

Here are the key numbers to watch for in 2015, according to Barclays:

Revenue - £1.65 billion

Underlying operating profit - £327 million

Margin - 19.8%

Underlying earnings per share - 31.2p

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.