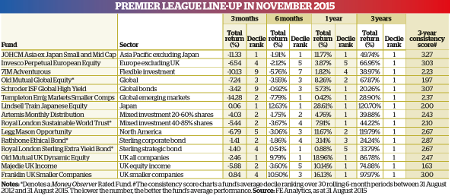

Regional equity funds: Premier League Nov 15 update

11th November 2015 10:00

Europe ex UK sector

Invesco Perpetual European Equity

, launched in 1986, is a stalwart of the Europe ex UK sector. Its pedigree is reflected in its £1.5 billion of assets under management and solid long-term performance record.

Over the 20 years to 31 August 2015 the fund delivered 420% for its investors, compared with 338% from the average fund in the sector. Over 10 years it delivered 107%, compared with 89% from the sector. These figures mark it out as a steady choice for those looking for exposure to European growth stocks.

More important for our league is the fund's three-year performance. It delivered the fifth best returns of the 108 funds in the sector over the period. Jeffrey Taylor has managed the fund since 2001, using a value-driven investment style that he credits for the fund's success.

| Introduction |

| UK equity funds |

| Regional equity funds |

| Global equity funds |

| Bond funds |

| Mixed assets funds |

He says: "Going through the eurozone crisis, great companies with growth ahead of them were priced for a dismal future. I never held that view, so by 2012 my fund had significant exposures to financials, industrial and consumer cyclicals, Spain and Italy."

Following the same philosophy, Taylor has taken an interest in the oil and gas sector. This hasn't paid off over the short term. However, Taylor has confidence in his convictions, and a track record for punchy but profitable decisions to boot.

North America sector

Legg Mason Opportunity

The second-best performer in our league over three years is North America fund , which returned close to 120% between August 2012 and August 2015 - more than double the return from the average fund in the North America sector.

The $311 million (£200 million) fund takes a long-term, value-driven approach that manager Samantha McLemore says has worked well in the post-crisis environment.

"It has been a great environment for our type of investing. The market has got more and more short term, and people are trying to time things perfectly. So if you're able to take a long-term view, you can find great opportunities," she says.

Some of the fund's best investments since 2011 have been in housebuilders and financial companies, sectors shunned in the wake of the financial crisis.

Recently, sell-offs have dented the portfolio. However, McLemore says: "People are focused on risk management and will sell stocks just because those stocks are declining. We tend to look toward those areas as opportunities."

Asia Pacific ex Japan sector

JOHCM Asia ex Japan Small and Mid Cap

A new entrant to Interactive Investor's sister website Money Observer's Premier League, has earned its place in our league table by delivering spectacular returns over the past three years.

Launched in September 2011, the fund is one of the youngest in the Asia Pacific ex Japan sector, and with just £45 million of assets under management, it is also one of the smallest.

Nonetheless, manager Cho Yu Kooi and her team have managed to outperform all their 97 sector peers over three years, one year and six months to 31 August, with returns of 50, 12 and -2% respectively.

Juliet Schooling Latter, research director at Chelsea Financial Services, says: "The companies the fund invests in need to be sustainable in the tough, cyclical markets of Asia - very handy at the moment."

She adds that the team operates a "robust process" and is invested across a good spread of companies. As at 31 August, the fund had an overweight to India and underweight to China, which paid off when China's stockmarket took a spectacular tumble recently. The fund has a steep ongoing charges figure of 2%. However, this should fall as the fund grows.

Japan sector

Lindsell Train Japanese Equity

is arguably the most successful Japan fund of the past three years. Its return of 121% was well over double the average in the Japan sector, which also makes the fund the best performer of all our Premier League players over that period.

It has also beaten its benchmark, the Topix index, by some way. The index returned 48% between August 2012 and August 2015, in one of the best periods for Japanese equities in more than two decades.

The fund has been managed by Japan expert Michael Lindsell since its launch in 1998. Like his business partner Nick Train, Lindsell prefers to run a highly concentrated, high-conviction portfolio.

He says: "We will only invest in durable, cash-generative businesses. But we invest in only a few of the companies we judge to be best value. We then hold onto them for as long as possible to benefit from the compounding inherent in all of them."

Lindsell credits this "idiosyncratic approach to investment" for the fund's success, but hedging has also been crucial.

The fund is one of few to have fully hedged out its exposure to the Japanese yen during a period when the currency has fallen by around 30% (since 2012). With a new round of quantitative easing widely anticipated, this strategy may yet continue to prove fruitful for the fund.

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks