How to make profits in late-stage bull market

10th November 2015 17:47

by Lee Wild from interactive investor

Share on

There are a number of likely consequences when the US Federal Reserve begins raising interest rates. Borrowing money becomes more expensive, savings rates increase and the dollar rally will likely extend. It's this point in previous hiking cycles that has signalled the end of a bull market. Investors, however, would do well to check out the statistics before pushing the 'sell' button.

Certainly, the omens do not look great. No bull market since before the 1970's has ended without a recession, warns UBS, and, at 81 months and counting, the current bull market is the third-longest and fifth-largest rally since the Great Depression.

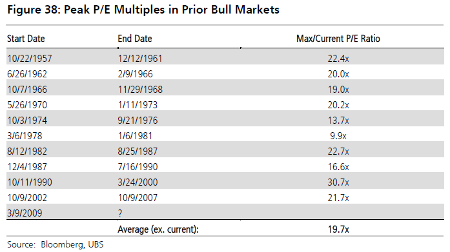

Since the current bull market began in March 2009, the S&P 500 is up an astonishing 210% compared with an average bull market return of 138%. Fed rate hikes and an M&A boom in its third year have all preceded past market tops, too, but not before a rally extension of both duration and total returns (see table below).

(Click to enlarge)

And balance sheets are much stronger now, providing firepower for takeover activity, and despite a rush of profit warnings, corporate earnings are tipped to generate modest earnings growth in 2016. As long as they do, and barring an unforeseen external shock or a recession, next year should be a positive year for US equities, says UBS.

It sees neither valuation or sentiment excesses, and UBS's American economics and credit strategy teams see no sign of a recession yet. Indeed, if they've got their numbers right, earnings per share for US companies will have risen 5% in 2016 to $126 and 5.2% in 2017 to $132.50, driven more by top line growth this time rather than cost cutting and fatter margins.

And, after projected modest growth of 3.2% in 2015, the S&P 500 is tipped to jump 7.1% next year to 2,275. That would put the broader US index on a forward price/earnings (PE) ratio of 17.2 times, a slight re-rating "justified given the prospective growth profile for US companies, the health of corporate balance sheets, a continued low interest rate environment and the potential for upside to our EPS forecasts".

Multiples have been higher during past peaks, too, and a trailing multiple of 19 times is still less than the average peak multiple for all post World War II bull markets of about 20 times trailing S&P earnings.

(Click to enlarge)

And if the market decides it can cope with a first hike in US rates for nine years, as early as December, according to UBS, upside to the broker's forecasts could be substantial. "Higher volatility expands potential downside and upside outcomes," it explains. "Upside to a multiple near prior peaks is catalyzed by positive Fed reaction, a China "soft landing" and a long awaited return of the Public as buyers."

"Stocks are historically strong in the October to April period; an overshoot is likely in 1H2016 prior to a focus on the November 8 US Elections."

That sounds plausible, especially if the US economy continues to grow at a decent lick. But what if it doesn't? Concerns about market liquidity go hand-in-hand with rate tightening, and any market surprise has the potential to "cause volatility which could easily exceed that seen in August 2015," writes UBS. "The potential is for rapid compression below the 2015 low at 1,867.01 toward 1,750, ending the bull market - since in no ongoing bull market since the 1970's has the next year traded below the preceding year's low price. Markets could, in our view, become disorderly in such a situation."

Statistics imply that further upside is achievable over the next few months, possibly much longer. And UBS certainly makes a convincing argument. Lance Roberts at STA Wealth Management, who regularly appears on Interactive Investor, tends to agree, but has for months been urging investors to tread carefully.

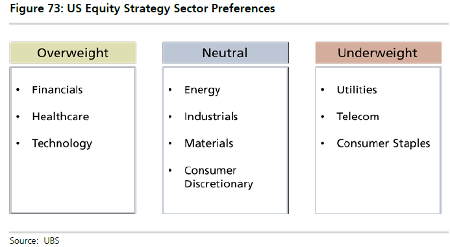

For investors prepared to bet on winners in this late stage bull market, UBS kindly offers some ideas, predominantly companies with limited sensitivity to rising rates, stocks with large cash balances (15% or more of total assets) and which have a proven ability to grow revenues year-on-year over the past five years.

(Click to enlarge)

Among UBS's 30 picks are , , , Google-owner , , and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.